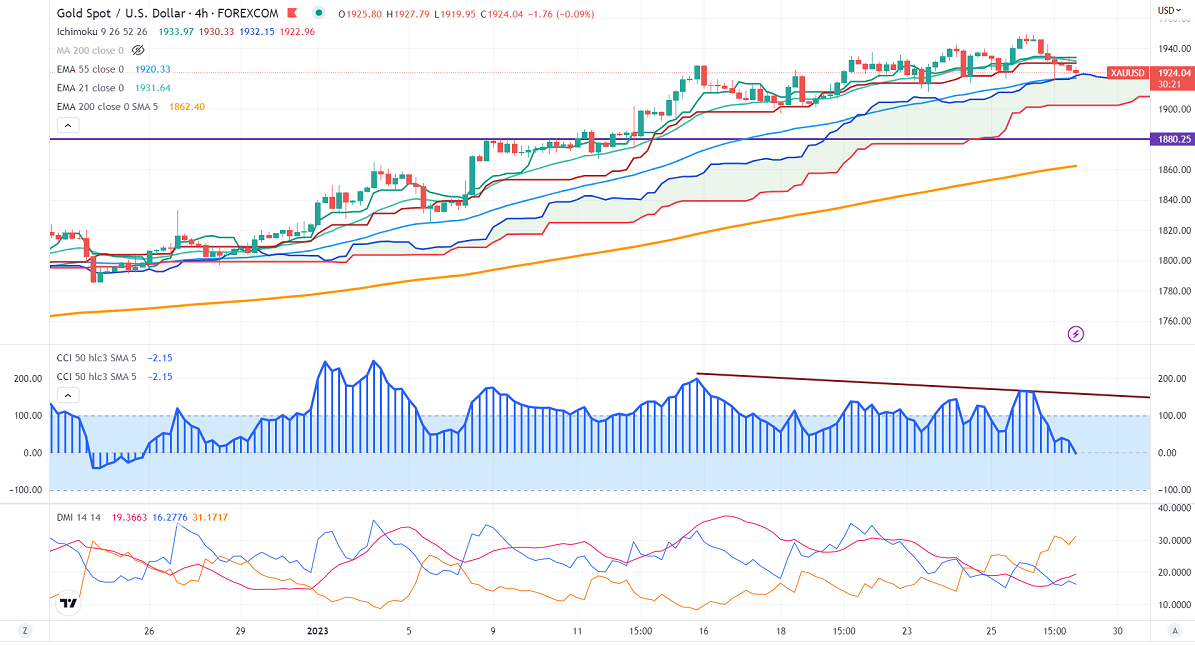

Ichimoku Analysis (4- hour chart)

Tenken-Sen- $1933.97

Kijun-Sen- $1930.33

Gold pared some of its gains ahead of US PCE data. The yellow metal showed a minor sell-off on upbeat US GDP data. It hits a low of $1917.21 yesterday and is currently trading around $1930.70.

The US economy expanded at an annual rate of 2.9% in Q4, above expectations of 2.6%. the number of people who have filed for unemployment benefits in the week ending Jan 21 st compared to the forecast of 205K.

US dollar index- Bearish. Minor support around 101.50/100. The near-term resistance is 103.50/104.50.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb rose to 98.1% from 96.80% a week ago.

The US 10-year yield jumped slightly after upbeat US economic data. Any break and close below 3.26% confirm minor bearishness. The yield spread between 10 and 2-year narrowed to -69.5 basis points from -75 bpbs.

Factors to watch for gold price action-

Global stock market- bearish (bullish for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1890, a break below targets of $1865/$1825.The yellow metal faces minor resistance around $1935, and a breach above will take it to the next level of $1950/$1969.

It is good to buy on dips around $1890 with SL around $1880 for TP of $1935/$1950.