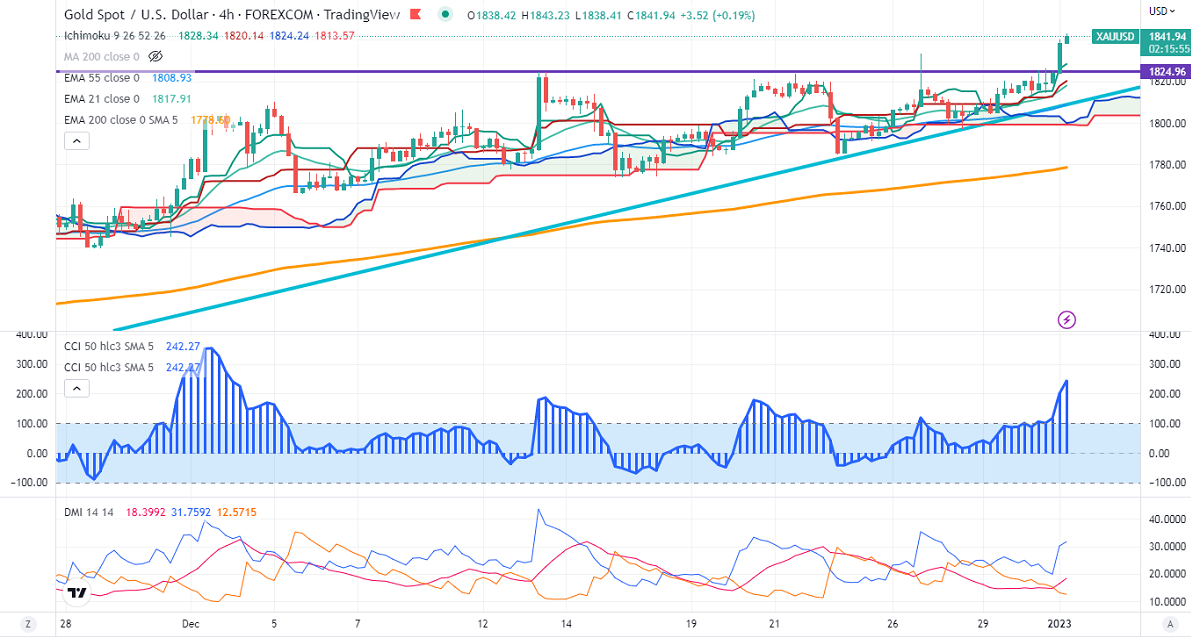

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1826

Kijun-Sen- $1817.75

Gold gained sharply and hit 7 months high on the weak US dollar. The global recession and the increase in Covid case in China has increased demand for safe-haven assets like yen, and gold. The yellow metal hits a high of $1843.50 and is currently trading around $1841.50.

US dollar index- Bearish. Minor support around 103.40/102. The near-term resistance is at 104.60/106.

The US 10-year yield is trading flat after hitting a half-month high. The yield spread between 10 and 2-year widened to -61.3 basis points from -46.9 bpbs.

Factors to watch for gold price action-

Global stock market- weak (bullish for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

The near–term support is around $1825, a break below targets of $1807/$1780/$1760.The yellow metal faces minor resistance around $1850, and a breach above will take it to the next level of $1860 /$1900.

It is good to buy on dips around $1800 with SL around $1775 for TP of $1850.