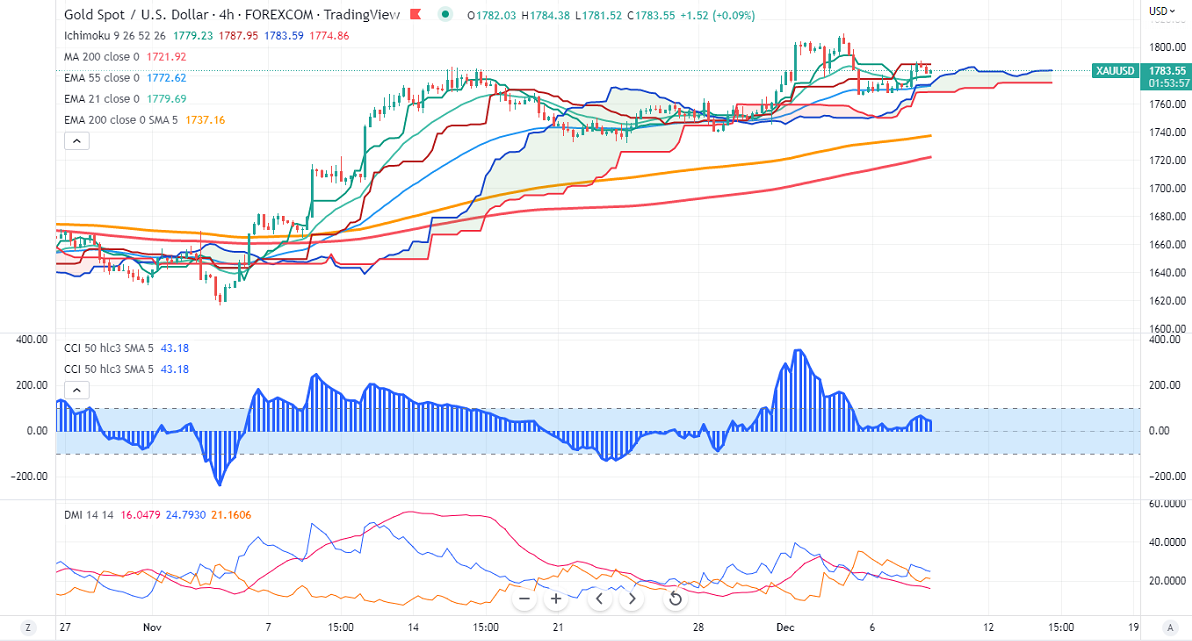

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1778.95

Kijun-Sen- $1787.95

Gold surged more than $20 after hitting a low of $1765 on the weak US dollar. The demand for riskier assets showed a jump after China eased zero Covid restrictions. Markets eye US initial jobless claims and ECB President Speech for further direction. The yellow metal was the best performer the previous month as declining US CPI decreased the chance of an aggressive rate hike by the Fed. The yellow metal hits a high of $1810 and is currently trading around $1782.95.

US dollar index- Bearish. Minor resistance around 105.50/106.20. The near-term support is at 104.80.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec declined to 74.70% from 75.80% a week ago.

The US 10-year yield gained more than 1.5% from yesterday's low of 3.404%. The US 10 and 2-year spread widened to -83.30 basis points from -67 bpbs.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1760, a break below targets of $1740$1720/$1700. The yellow metal faces minor resistance around $1820, breach above will take it to the next level of $1860/$1900.

It is good to buy on dips around $1760 with SL around $1740 for TP of $1860.