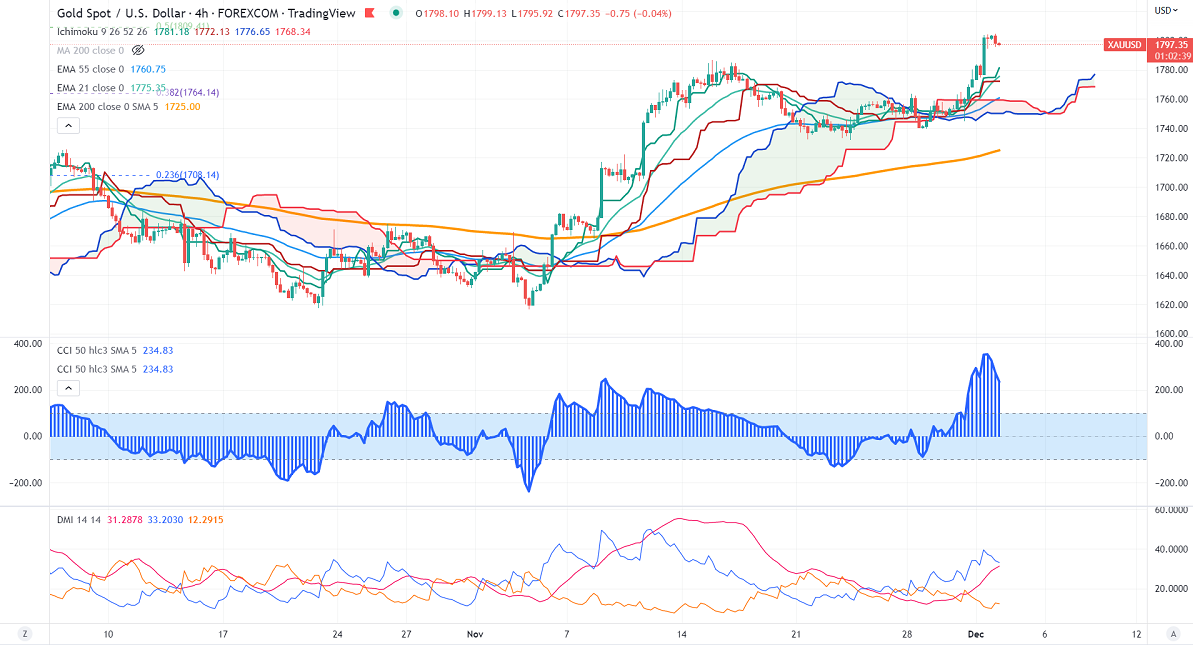

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1762.55

Kijun-Sen- $1759.88

Gold trades higher for the third consecutive day on dovish Fed Chairman and weak US economic data. The US dollar index extends its weakness after PCE inflation. It declined to 6% yearly in Oct, below market expectations of 6.2%. The yellow metal hits a high of $1804 yesterday and is currently trading around $1797.55.

US dollar index- Bearish. Minor resistance around 106.20/107.25. The near-term support is at 103.90.

US ISM manufacturing PMI dropped to 49 in Nov compared to a forecast of 49.70. Markets eye the US NFP for further direction.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Dec dropped to 20.6% from 24.2% a day ago.

The US 10-year yield lost more than 7.5% in the past two trading days. The US 10 and 2-year spread narrowed to -71.8 basis points from -80 bpbs.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1780, a break below targets of $1760/$1740. The yellow metal faces minor resistance around $1805, breach above will take it to the next level of $1825/$1860.

It is good to buy on dips around $1770-71 with SL around $1750 for TP of $1860.