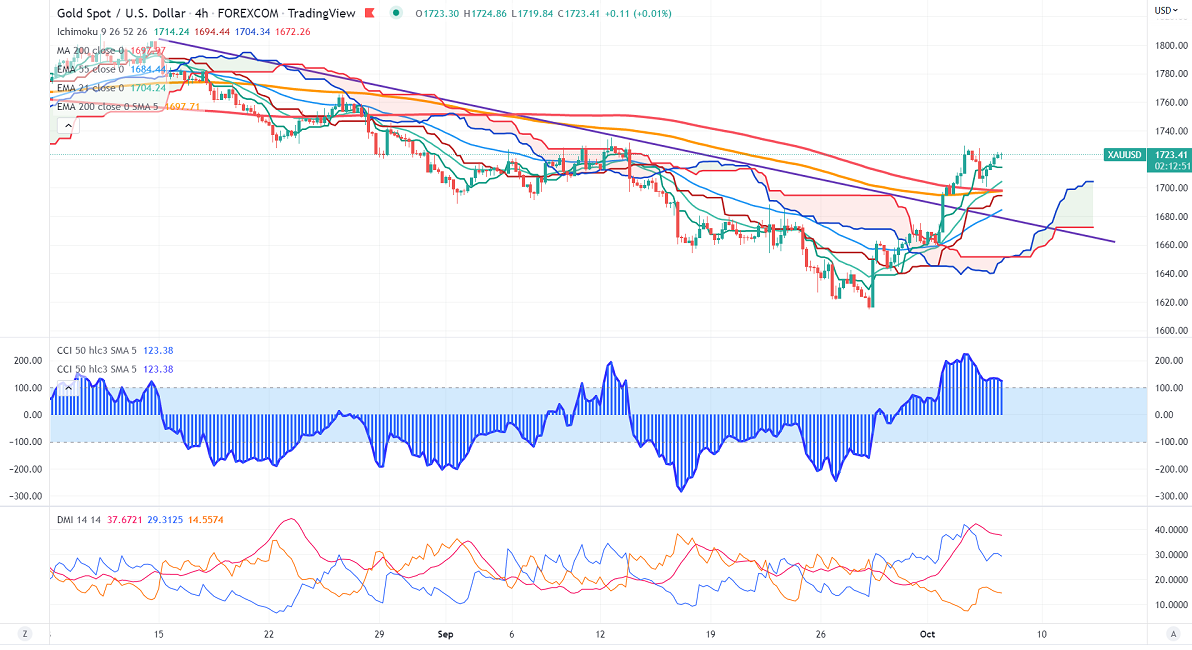

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- $1714.24

Kijun-Sen- $1694.44

Gold jumped sharply and holds above $1700 on the weak US dollar. The lackluster performance in US treasury yields and increased demand for safe-haven assets like gold on rumors of Credit Suisse collapse. The DXY rebounded slightly after hitting a low of 110.06 any close confirms further bearishness.

US 10-year yield recovered more than 6% from a minor bottom of 3.56%. The US 10 and 2-year spread narrowed to -48 basis points from -41 bpbs.

US private companies have added 208K jobs in Sep compared to a forecast of 200K.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov declined to 69.4% from 64.70% a week ago.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1677, a close below targets $1665/$1650.The yellow metal faces minor resistance around $1730, the breach above will take it to the next level of $1740/1760/$1800. Minor bullish continuation only if it breaks $1740.

It is good to buy on dips around $1678 with SL around $1660 for TP of $1740.