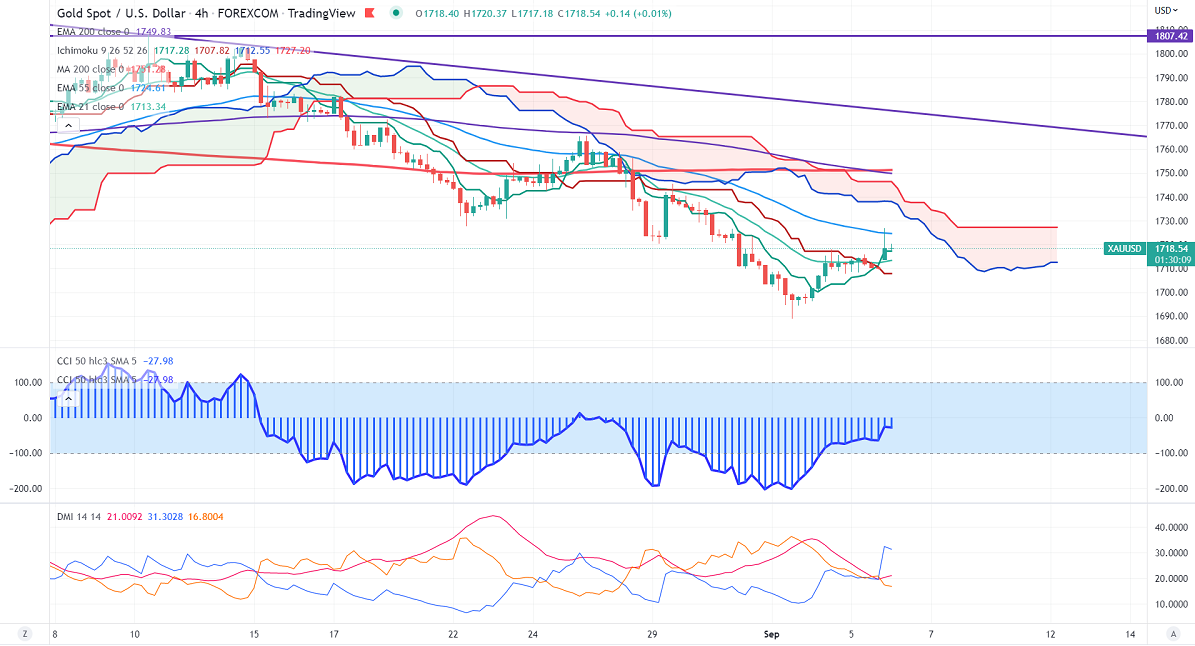

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- $1717.28

Kijun-Sen- $1708.72

Gold price showed a minor pullback as the US dollar pared some of its gains. The US dollar was one of the best performers in the past four weeks and surged more than 500 pips on hopes of an aggressive rate hike by the Fed. The chance of a recession in Europe is due to the energy crisis preventing yellow metal from further sell-off. Markets eye US ISM services PMI for further direction.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep dropped to 61% from 75% a week ago.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bullish (Negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1690, a close below targets $1671/$1650/$1600. Significant reversal only below $1650. The yellow metal faces minor resistance around $1720, breach above will take it to the next level of $1740/$1760/$1775/$1800/$1820.

It is good to buy on dips around $1697-98 with SL at around $1681 for TP of $1800.