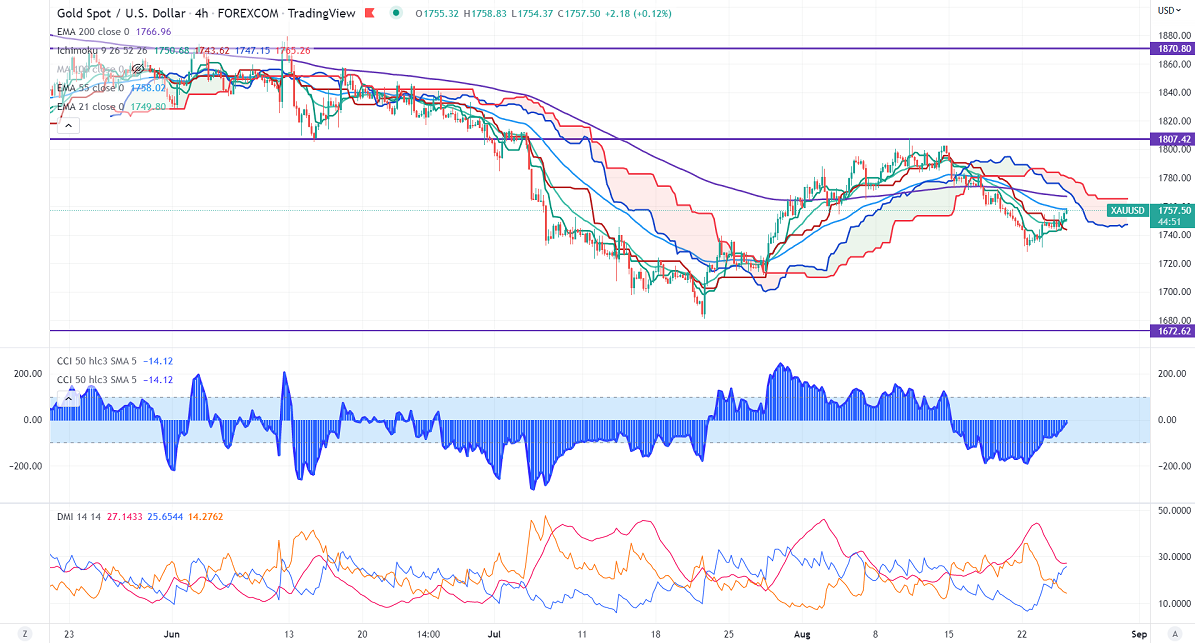

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- $1749.60

Kijun-Sen- $1744.55

Gold price regained above $1750 as the US dollar slipped. Markets eye US Fed chairman Powell's speech in Jack son hole for further direction. Any break below 108 confirms further bearishness.

US new orders for manufactured goods came flat compared to a forecast of 0.90% While core durable goods orders rose by 0.30%in July. The US pending home sales dropped for the sixth time this year and slipped 1% in Jul.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 58% from 41% a week ago.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1740, a breach below targets $1720/$1700/$1650. Significant reversal only below $1650. The yellow metal faces minor resistance around $1760, breach above will take it to the next level of $1775/$1800/$1820.

It is good to sell on rallies around $1760-61 with SL at around $1781 for TP of $1700.