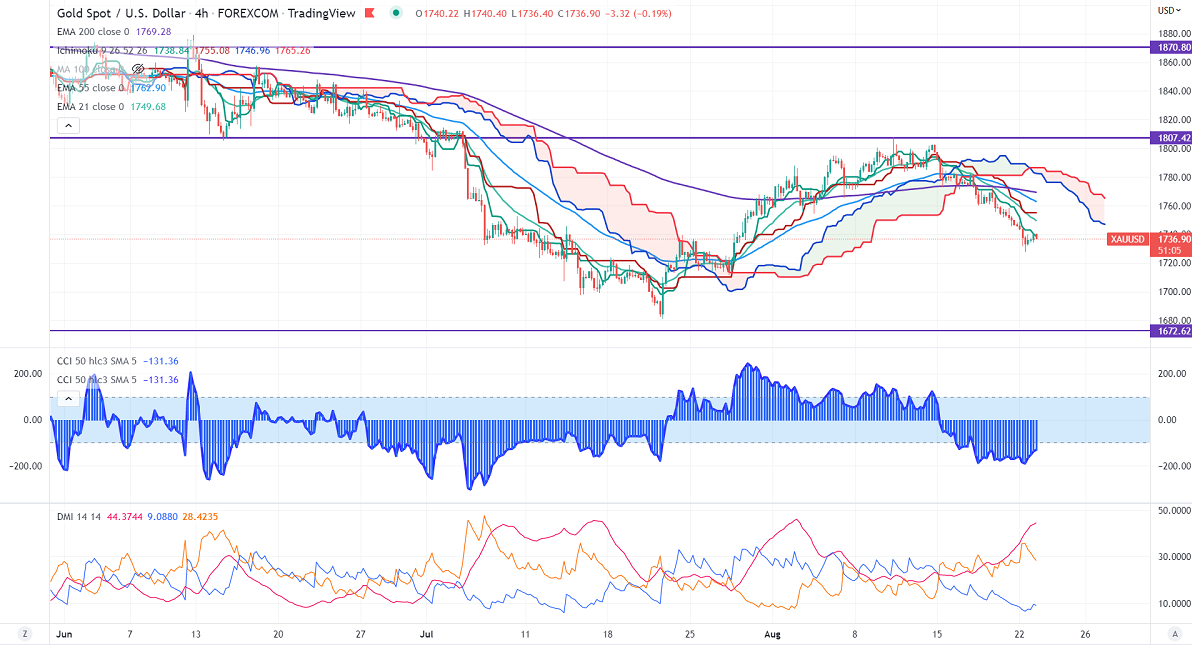

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- $1740.17

Kijun-Sen- $1755

Gold price trading weak on strong US dollar. It recovered sharply and hits a five-week high ahead of the Jackson hole symposium. Any close above 109.30 confirms further bullishness.

Markets eye US Flash services PMI, new home sales, and Richmond Manufacturing index for further direction.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 58% from 45% a week ago.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bullish (Negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1720, a breach below targets $1700/$1650. Significant reversal only below $1650. The yellow metal faces minor resistance around $1760, breach above will take it to the next level of $1775/$1800/$1820.

It is good to sell on rallies around $1760-61 with SL at around $1781 for TP of $1700.