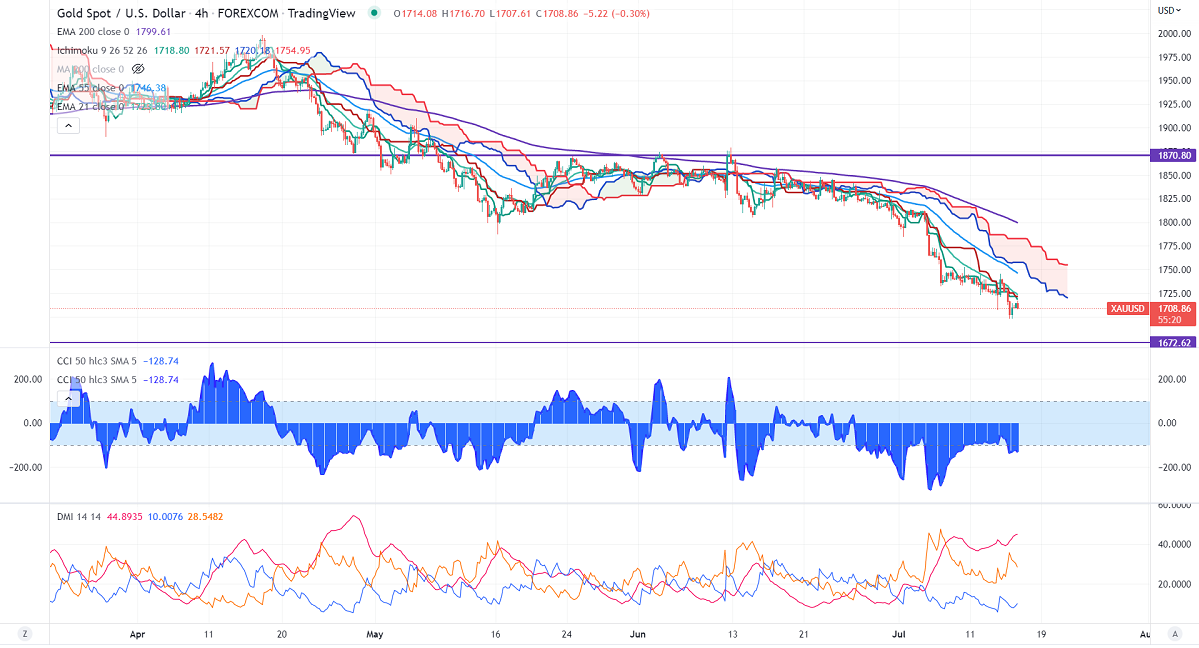

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1721.57

Kijun-Sen- $1721.57

Gold price pared some of its gains after upbeat US PPI data. The Producer price index rose 11.3% in the 12 months through June, the highest reading since Mar 2022. The number of people who have applied for jobless benefits rose by 9000 last week to 244000 compared to a forecast of 235000. The Producer price index rose 11.3% in the 12 months through June, the highest reading since Mar 2022. The number of people who have applied for jobless benefits rose by 9000 last week to 244000 compared to a forecast of 235000.US dollar index showed a profit booking after hitting a multi-year high of 109.29. According to the CME Fed watch tool, the probability of a 100 bpbs rate hike in Jul dropped to 48.8% from 7.680.3% a day ago.

Factors to watch for gold price action:

Global stock market- mixed (neutral for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1700, a breach below targets $1650/$1600—significant reversal only below $1600. The yellow metal faces minor resistance around $1720, any breach above will take it to the next level of $1732/$1745/$1770.

It is good to sell on rallies around $1750-52 with SL around $1770 for TP of $1700.