FxWirePro- Gold Daily Outlook

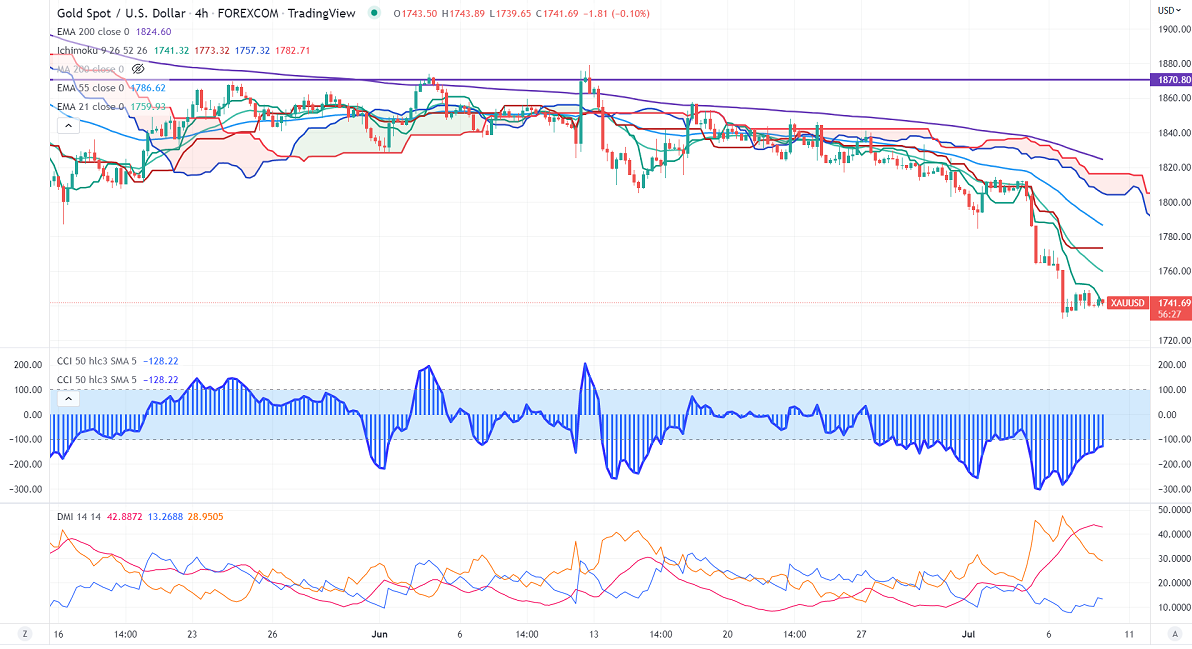

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1746.54

Kijun-Sen- $1773.32

Gold price consolidates after a massive sell-off of more than $80 this week. The surge in the US dollar on recession fears puts pressure on the yellow metal. US dollar index regained above 107 level. Any violation above the recent high of 107.264 confirms a bullish continuation.

The number of people who have filed for unemployment benefits rose by 4000 to 235000 previous week compared to an estimate of 230000. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jul rose to 92.7% from 82.6% a week ago. It hits a low of $1739 at the time of writing and is currently trading around $1742.07.

Markets eye US Nonfarm payroll data for further direction.

Factors to watch for gold price action-

Global stock market- mixed (neutral for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1730, a breach below targets $1700/$1650. Significant reversal only below $1700. The yellow metal faces minor resistance around $1760, any breach above will take it to the next level of $1780/$1800.

It is good to sell on rallies around $1750-52 with SL around $1770 for TP of $1700.