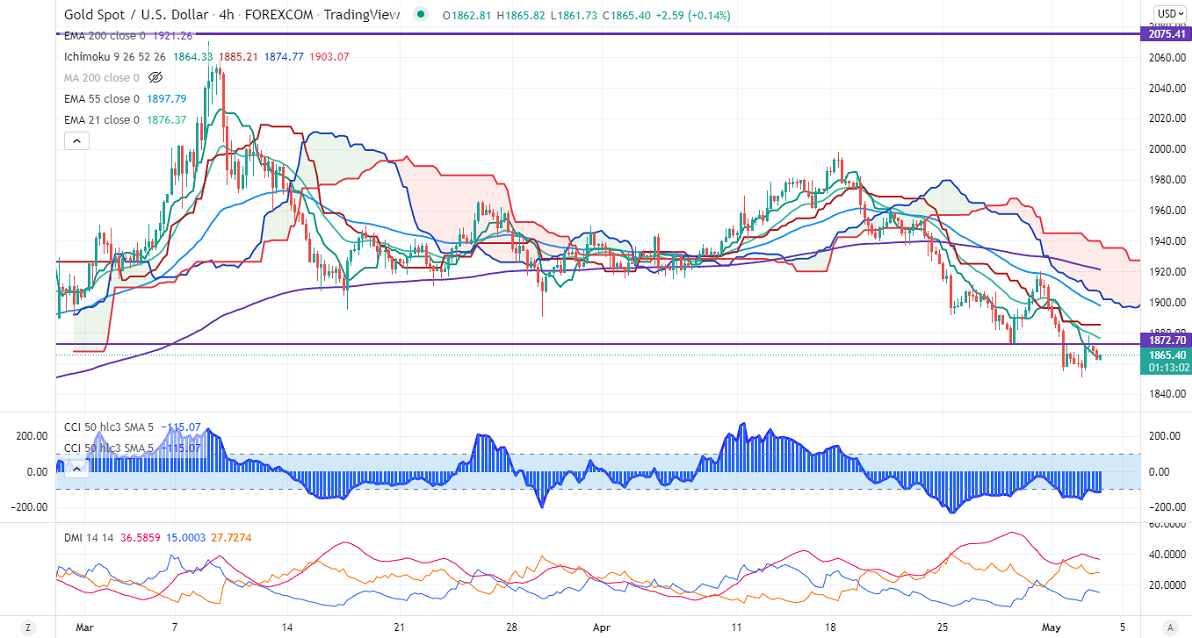

Ichimoku Analysis (4-hours Chart)

Tenken-Sen- $1904.15

Kijun-Sen- $1924.42

Gold gained slightly after a decline of $40 this week. Markets eye US Fed monetary policy for further direction. According to the Fed watch tool, the probability for a 50 bpbs rate hike in June has increased to 99.1% from 80.4% a week ago. Markets eye Fed comments about Quantitative tightening plan for further direction. The yellow metal hits an intraday high of $1869 and is currently trading around $1863.68.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1850, a breach below targets $1800/$1750. Significant reversal only below $1750.The yellow metal faces strong resistance of $1875, any breach above will take to the next level $1900/$1920.

It is good to sell on rallies around $1900 with SL around $1925 for TP of $175