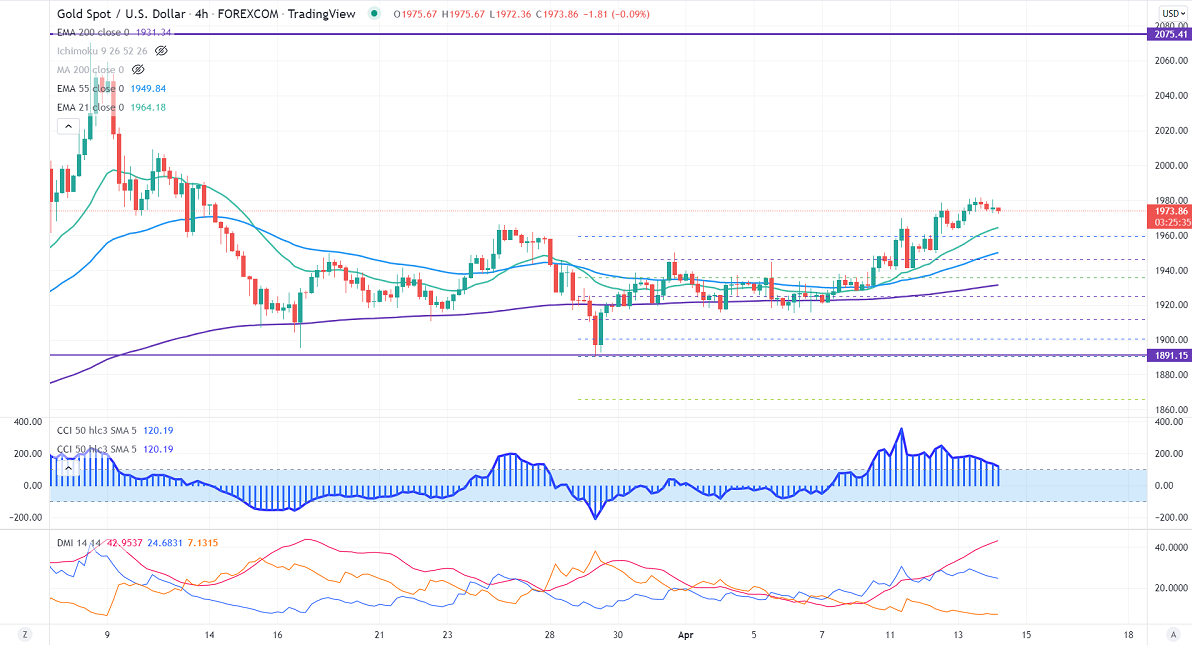

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1972.26

Kijun-Sen- $1954.70

Gold posted modest gains yesterday on another hot US inflation data. The surge in crude oil prices and weak US dollar index are other factors that support precious metals. The US dollar index tumbled below 100 levels on profit booking. Markets eye US retail sales for further direction. The yellow metal hits a high of $1981.95 and is currently trading around $1975.17.

Factors to watch for gold price action-

Global stock market- weak (Positive for gold)

US dollar index –Bearish (Positive for gold)

US 10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1960, breach below confirms the intraday bearish trend. A dip to $1949.70/$1940. Significant reversal only below $1890. The yellow metal faces strong resistance of $1982, any breach above will take to the next level $2000/$2020.

It is good to buy on dips around $1950-51 with SL around $1930 for TP of $2000.