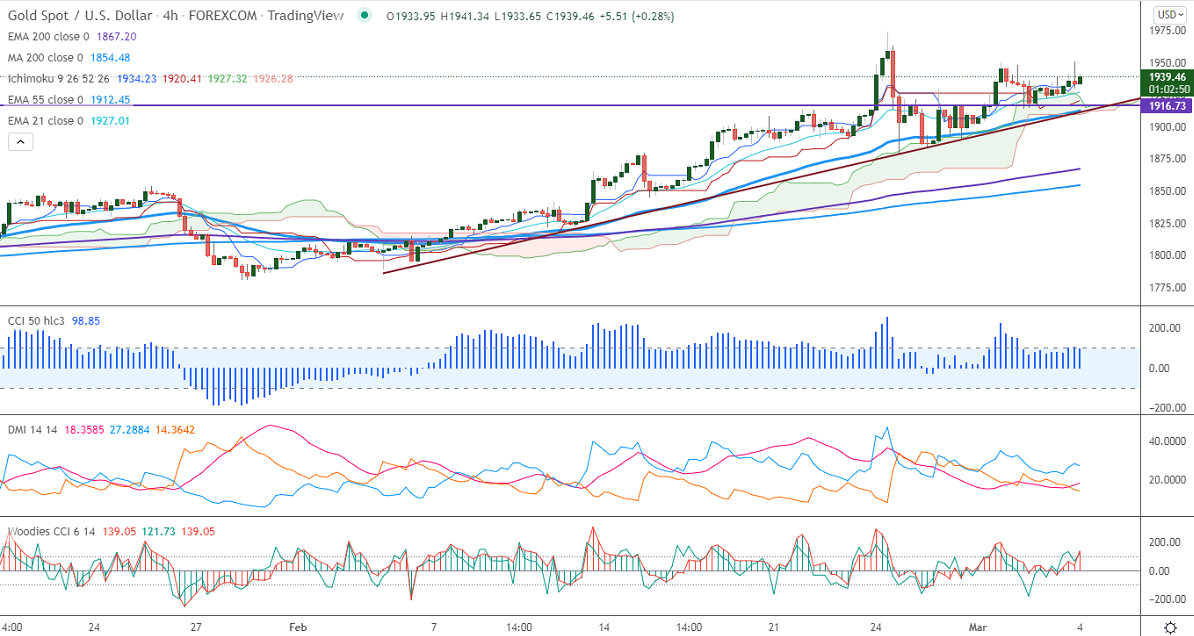

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1933.18

Kijun-Sen- $1918.50

Gold holds above the $1900 level despite the strong US dollar. Fears over Russia's attack on Europe's largest nuclear power plant in Ukraine have increased demand for safe-haven assets. Markets eye Russia and Ukraine peace talks. Gold hits a high of $1948 yesterday and is currently trading around $1922.26.

US ISM services PMI slowed to 56.5 in Feb., compared to forecast 61.2. Major data to be watched today US Non-Farm payroll.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1878, violation below targets $1857/$1838. Significant reversal only below $1750.The yellow metal faces strong resistance of $1952, any violation above will take to the next level $1960/$1980.

It is good to buy on dips for $1900 with SL around $1880 for TP of $1960.