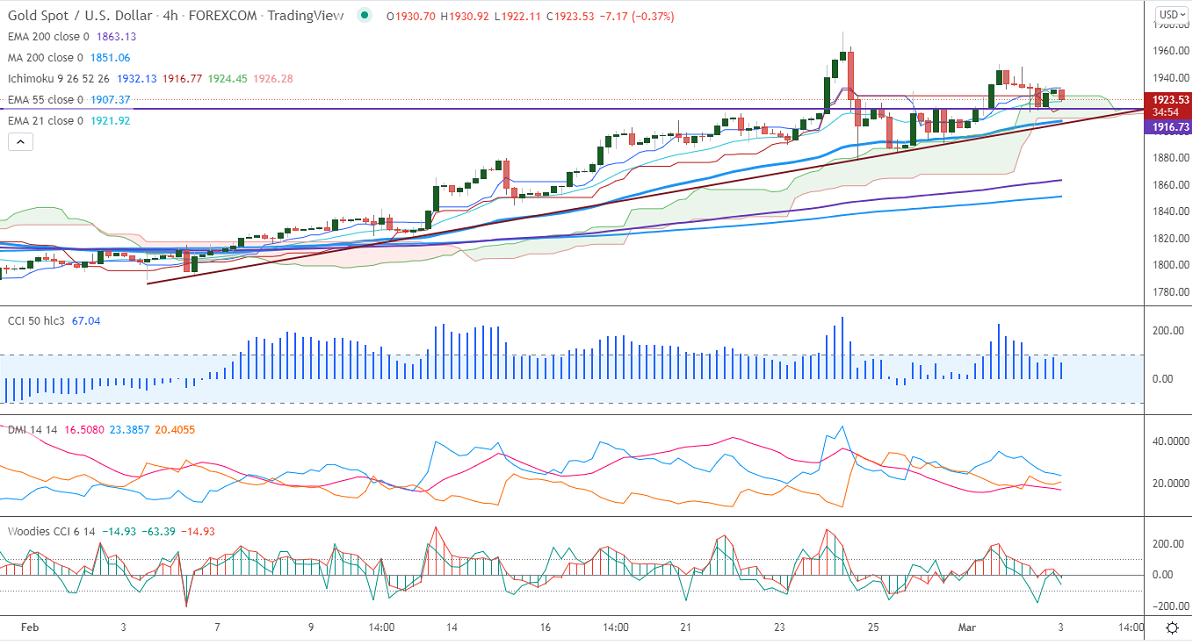

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1932.13

Kijun-Sen- $1914.21

Gold retreats from high of $1950 as Powell hints 25 basis point rate hike during March 15-16 policy meeting. "It is not yet knowable if the war in Ukraine affects our rate hike plan this year". The escalation of Russia and Ukraine tension has increased demand for safe-haven assets. Markets eye Russia and Ukraine peace talks. It hits a high of $1948 yesterday and is currently trading around $1922.26.

US private employers have added 475000 jobs in Feb better than expected 378K.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1878, violation below targets $1857/$1838. Significant reversal only below $1750.The yellow metal faces strong resistance of $1952, any violation above will take to the next level $1960/$1980.

It is good to buy on dips for $1900 with SL around $1880 for TP of $1960.