Gold hits six months high on weak US dollar and declining US treasury yields. The spread of omicron virus cases across the globe also supports the yellow metal. The other factor preventing gold from further upside is the tightening of monetary policy by major central banks. It hits a high of $1831.80 and is currently trading around $1825.69.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- bearish (positive for gold)

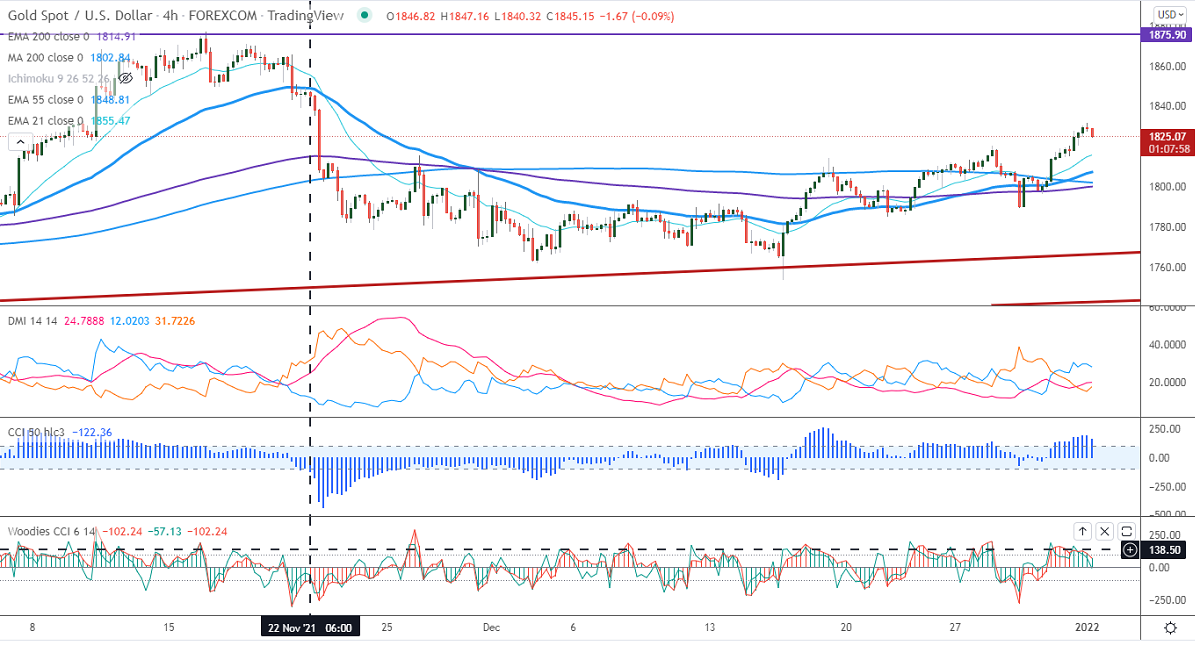

Technical:

The near–term major support is around $1817, violation below targets $1805/$1800/$1790. $1675.Significant trend reversal only below $1750.The yellow metal facing strong resistance $1835, any violation above will take to the next level $1860/$1877$1912 is possible.

It is good to buy on dips around $1800 with SL around $1780 for TP of $1860.