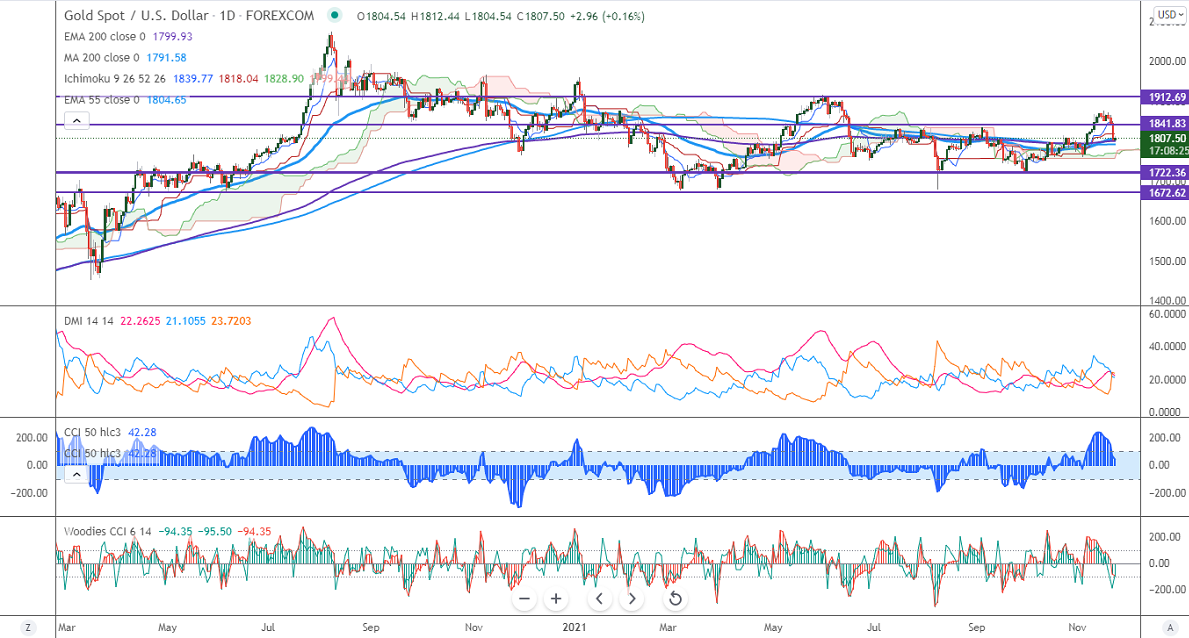

Ichimoku analysis (Daily chart)

Tenken-Sen- $1839

Kijun-Sen- $1818

Gold has shown a massive sell-off after US President Biden nominates Fed Chairman Powell for the second term. The US dollar index surged sharply and hits the highest level since Jul 2020. The minor pullback in US treasury yield also puts pressure on the yellow metal. It hits a low of $1802 and is currently trading around $1807.90.

Economic Data-

Markets eye flash Manufacturing and services PMI data for further direction.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bullish (Negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

It faces strong support at $1800, violation below targets $1780/$1770/$1760.Significant trend continuation only below $1675. The yellow metal facing strong resistance $1815, any breach above will take to the next level $1825/$1835/$1860 is possible.

It is good to sell on rallies around $1815-16 with SL around $1825 for TP of $1760.