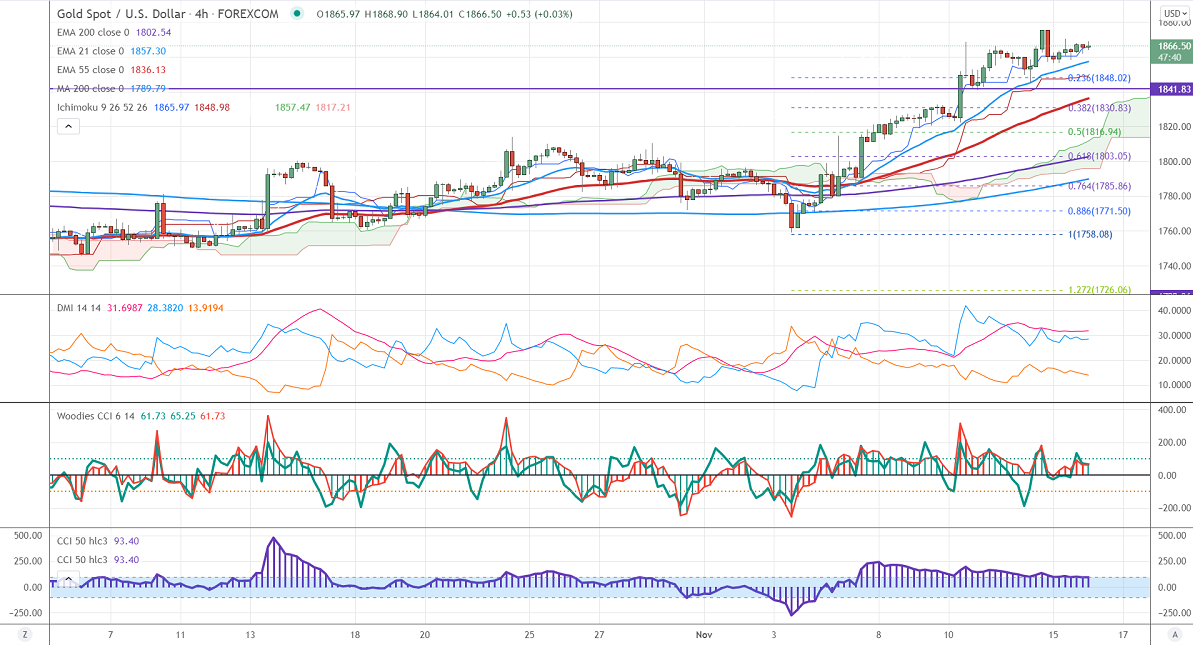

Ichimoku analysis (4 Hour chart)

Tenken-Sen- $1864.73

Kijun-Sen- $1848.98

Gold is trading flat despite the strong US dollar. The US dollar index surged sharply and hits the highest level since July 2020. The improved market sentiment due to a virtual meeting between Biden and Xi ping also putting pressure on the yellow metal. Markets eye US retail sales for further direction. Gold hits a high of $1870 and is currently trading around $1865.72.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

It faces strong support at $1855, violation below targets $1840/$1820/$1798/$1780. Significant trend continuation only below $1675. The yellow metal is facing strong resistance $1875, any breach above will take to the next level $1900/1915 is possible.

It is good to sell on rallies around $1870 with SL around $1880 for TP of $1800.