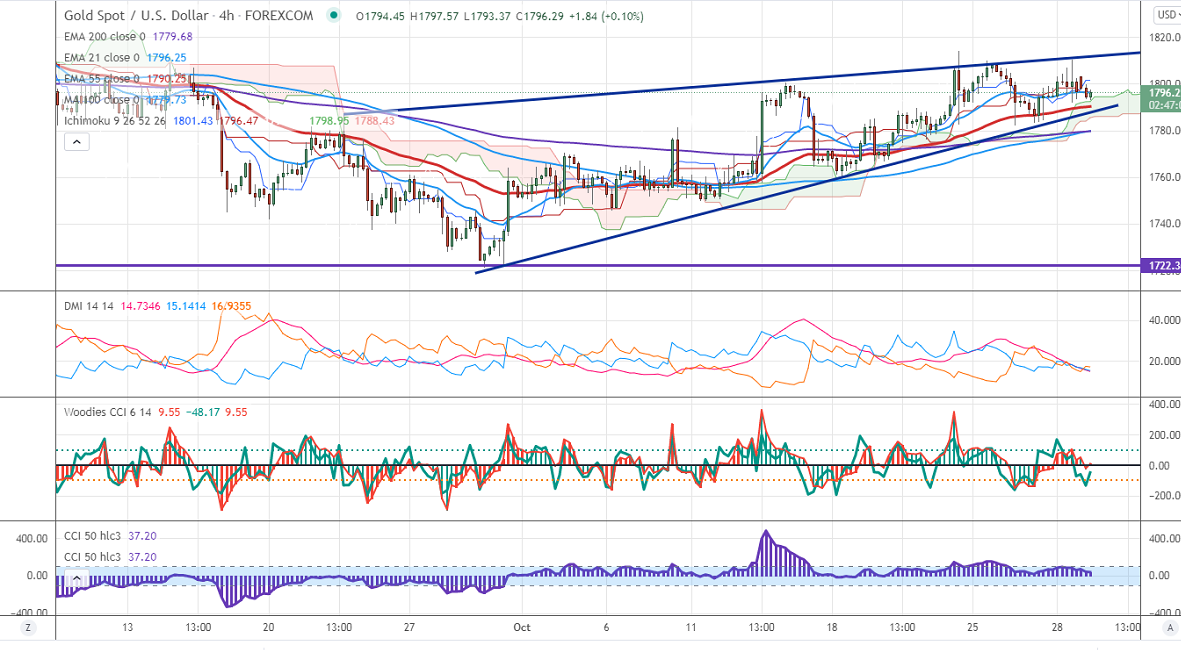

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1801.43

Kijun-Sen- $1796.47

Gold jumped to $1810 after weak US GDP data. US economy has grown only by 2% in the third quarter, the slowest pace of growth since the Corona pandemic. The US dollar index declined sharply after the GDP data. Any breach below 93.25 confirms further bearishness. Gold hits an intraday low of $1793.70 and is currently trading around $1796.69.

The European central bank has kept its rates unchanged and not to hike rates for 2022.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Slightly bullish (negative for gold)

Technical:

It is facing strong support at $1778 violation below targets $1770/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal $1835/$1850/$1860 is possible.

It is good to buy on dips around $1770-71 with SL around $1760 for TP of $1835.