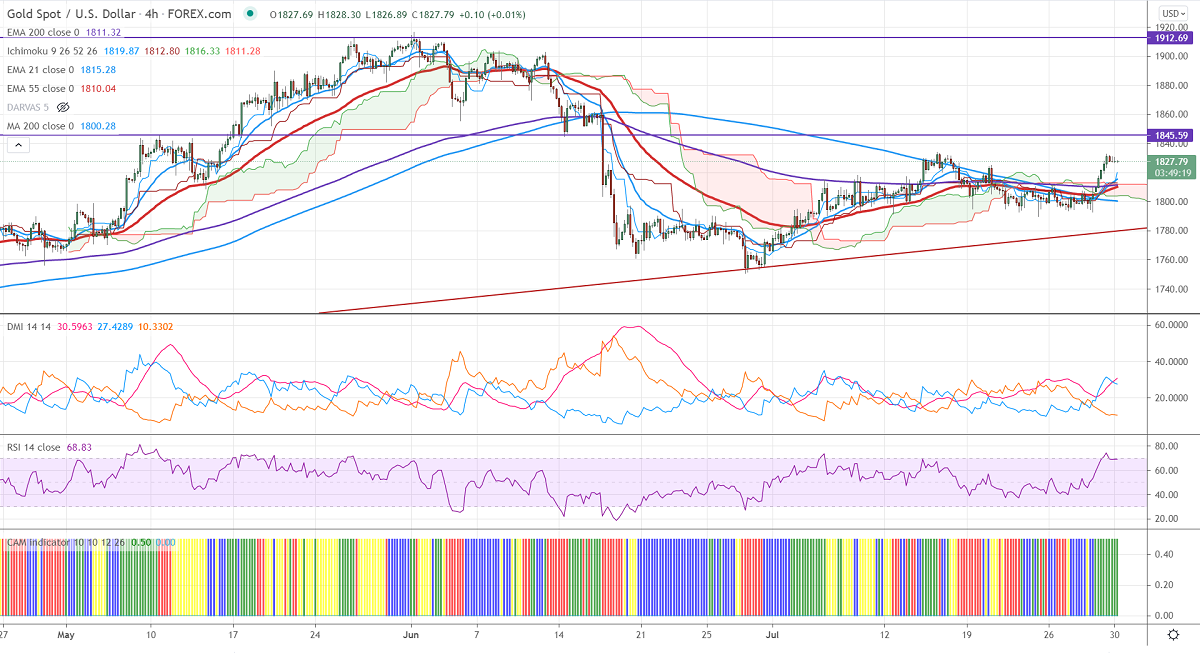

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1812.80

Kijun-Sen- $1812.80

Gold has broken significant resistance $1821 (200-day MA) on board-based US dollar selling. DXY lost more than 100 pips this week. Any breach below 91.65 confirms further bearishness. The US real bond yields hit a record low on growth concerns. The yellow metal hits an intraday high of $1817.53 and is currently trading around $1816.36.

Economic data:

US Gross domestic product surged at an annual rate of 6.3% in the second quarter slightly below the estimated 8.5%. The number of people who have filed for unemployment benefits by 24000 to 400000 last week compared to a forecast of 382000.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US10-year bond yield- Neutral

US dollar - Bearish (positive for gold)

Technical:

It is facing strong support at $1790 violation below targets $1780/$1765. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1835, any convincing break above will take the yellow metal $1860/$1900 is possible.

It is good to buy on dips around $1800 with SL around $1790 for TP of $1850.