Ichimoku analysis (Daily chart)

Tenken-Sen- $1812.82

Kijun-Sen- $1807

Gold declined below $1800 as risk sentiment recovers. The US treasury yields halted their one week of the bearish trend and shown a minor pullback. The spread of delta variant coronavirus is a factor to be watched. Gold hits an intraday low of $1797 and is currently trading around $1812.32.

Markets eye ECB monetary and US jobless claims for further direction.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index – Slightly bearish (positive for gold)

US10-year bond yield- bullish (bearish for gold)

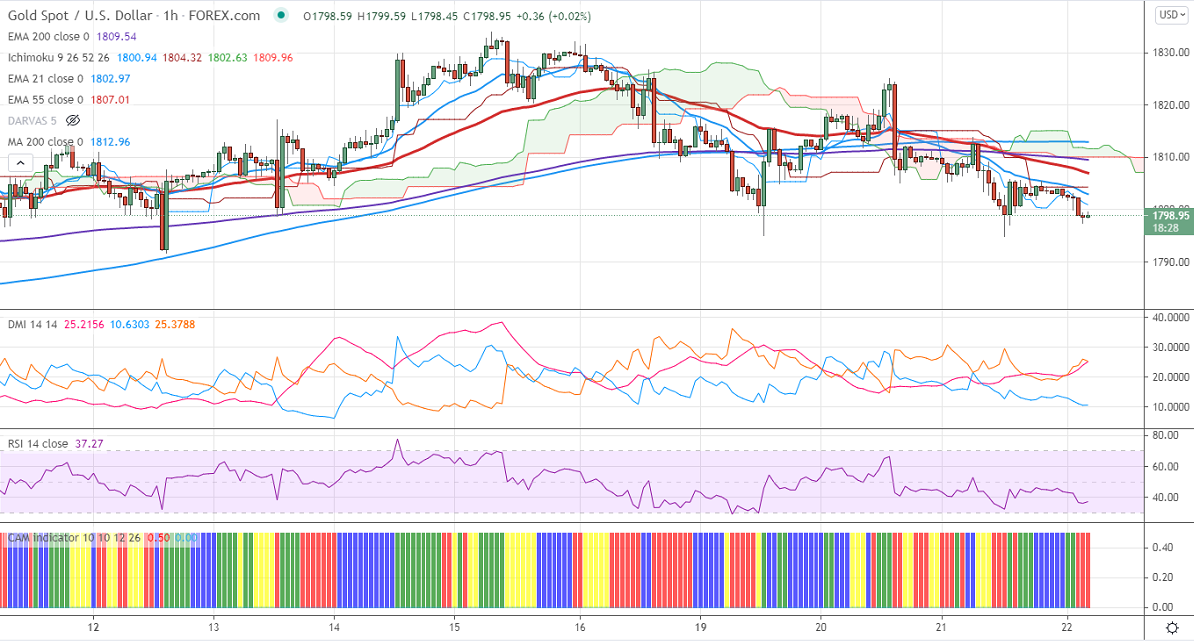

Technical:

It is facing strong support at $1790 violation below targets $1780/$1765. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1805, any convincing break above will take the yellow metal $1825/$1835/$1860/$1900 is possible.

It is good to sell on rallies around $1810-11 with SL around $1825 for TP of $1750.