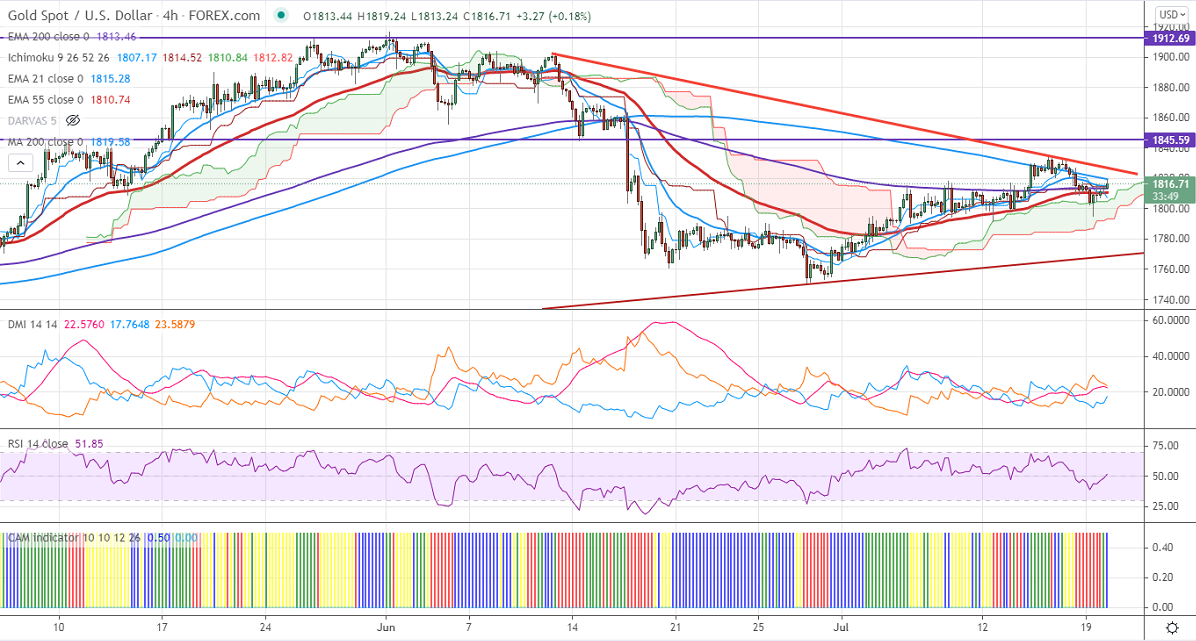

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1810.94

Kijun-Sen- $1814.52

Gold regained sharply after a minor sell-off below the $1800 level. The surge in the number of new coronavirus cases has increased demand for safe-haven assets like the gold, yen. The yellow meat hits an intraday high of $1819.25 and is currently trading around $1817.25.

Factors to watch for gold price action-

Global stock market- Extremely bearish (positive for gold)

US dollar index – Bullish slightly (negative for gold)

US10-year bond yield- weak (bullish for gold)

Technical:

It is facing strong support at $1780, violation below targets $1760/$1740/$1720/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1836, any convincing break above will take the yellow metal $1860/$1900 is possible.

It is good to buy on dips around $1805-06 with SL around $1790 for the TP of $1850.