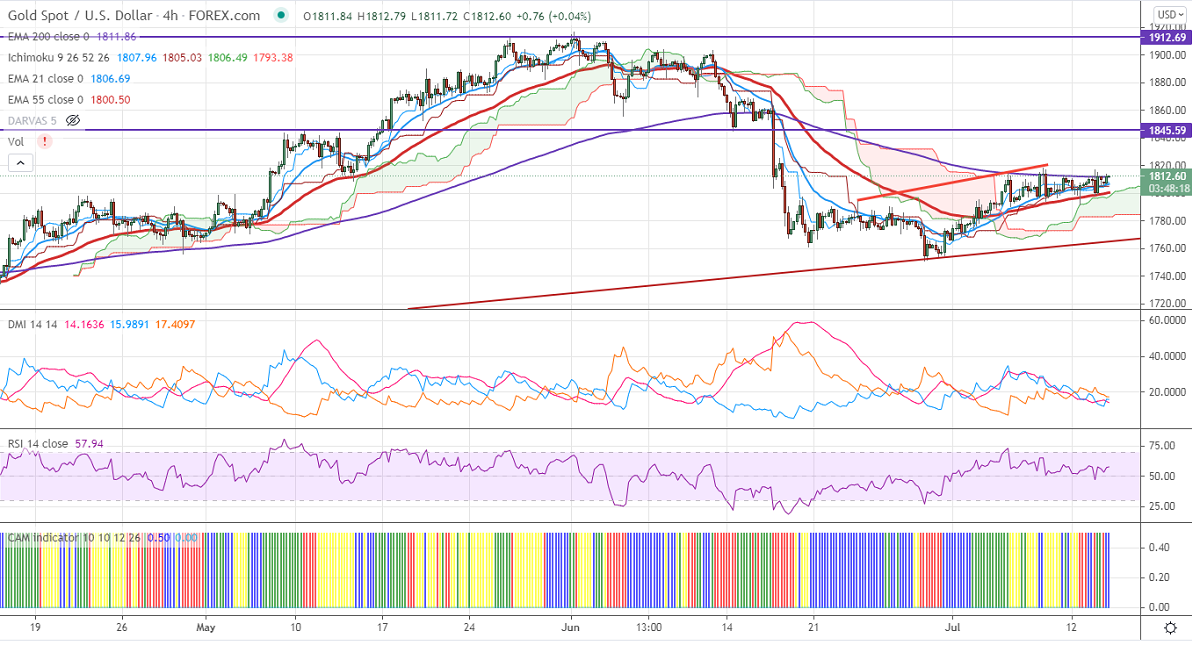

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1804

Kijun-Sen- $1805

Gold is holding above $1800 despite strong US inflation. The US CPI m/m came at 0.9% and 5.4% from the same month earlier, the highest level since 2008. The surge in inflation might increase the chance of rate hike by Fed much earlier than expected. The rebound of nearly 15% in the US 10-year yield is putting pressure on yellow metal at higher levels. It hits an intraday high of $1813.97 and is currently trading around $1812.88. Markets eye US PPI and US Fed chairman speech for further direction.

Technical:

It is facing strong support at $1790, violation below targets $1784/$1776/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal to $1836/$1860 is possible.

It is good to buy on dips around $1790-91 with SL around $1772 for the TP of $1836.