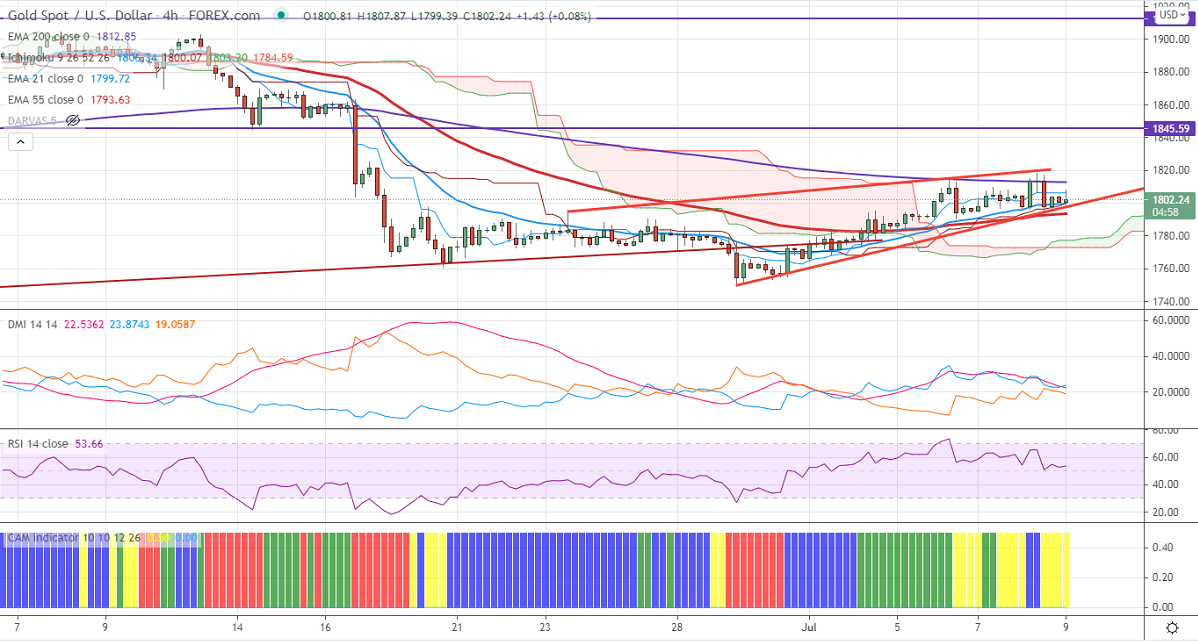

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1806

Kijun-Sen- $1798.40

Gold is trading highly volatile for the past two days and struggling to hold above $1800 levels. The dip in US yield countered surge in US dollar is protecting the yellow metal major selling. The spread of the Coronavirus in major parts of the world has increased the demand for safe-haven assets. The rise in the number of new cases in the US, the UK due to delta variant is the cause of concern. The US 10- year yield has halted its four-month and shown a minor jump of more than 7%. The yellow metal hits a high of $1805 yesterday and is currently trading around $1796.94.

The number of people who have filed for unemployment benefits rose to 373000 last week compared to an estimate of 350000.

Technical:

It is facing strong support at $1793, violation below targets $1775/$1760/$1750. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal to $1836/$1860 is possible.

It is good to buy on dips at $1790 with SL around $1780 for the TP of $1835.