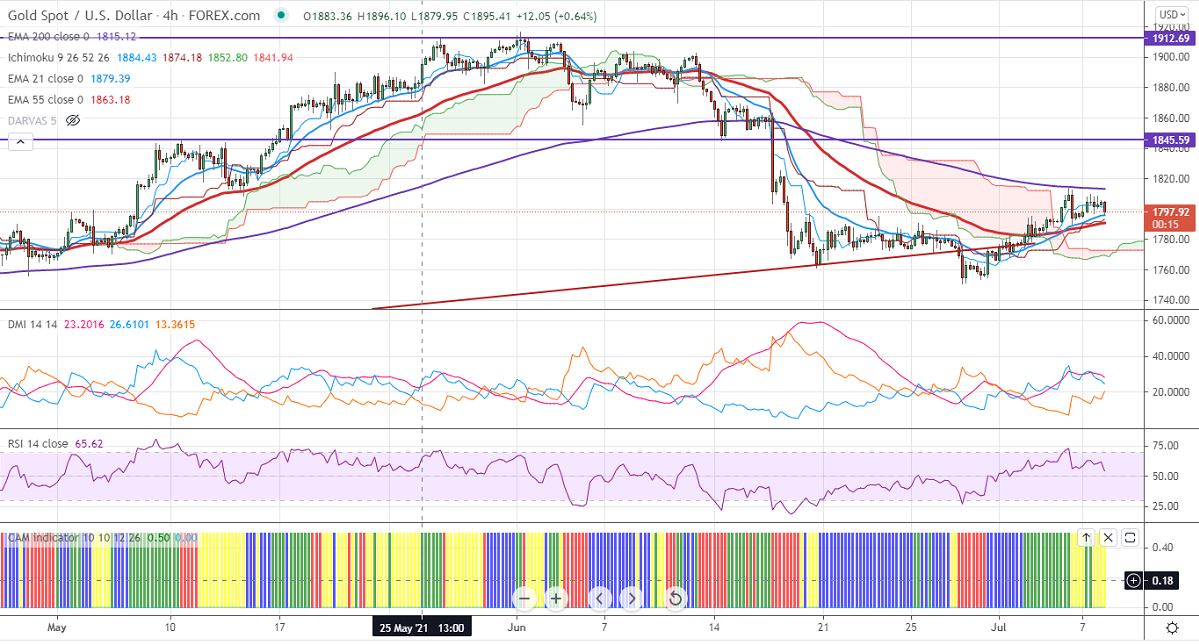

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1801.48

Kijun-Sen- $1793

Gold is holding above $1800 following FOMC meeting minutes. The minutes of the Fed reflect more optimism over US economic recovery. The Fed has not given any timeline for the scale-back QE program due to the uncertainty. The falling of US bond yield is preventing the yellow metal from further fall. The US 10- year yield declined more than 12%, hits the lowest since Feb. DXY continues to trade higher for the second consecutive week. A jump till 93.07 is possible. The yellow metal hits a high of $1805 yesterday and is currently trading around $1796.94.

Technical:

It is facing strong support at $1780, violation below targets $1773/$1768/$1753. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal to $1836/$1860 is possible.

It is good to buy on dips at $1790 with SL around $1780 for the TP of $1835.