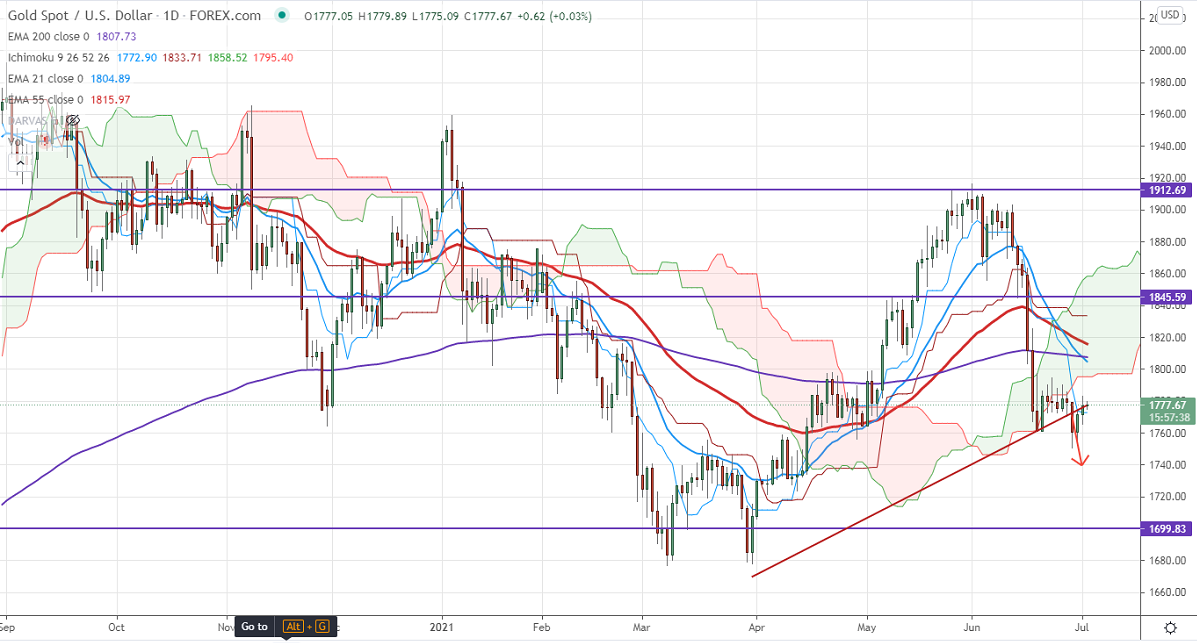

Ichimoku analysis (Daily chart)

Tenken-Sen- $1772

Kijun-Sen- $1833

Gold is consolidating ahead of US non-farm payroll. The further sell-off in yellow metal will happen if US jobs beat estimates. The US economy expected to add 725K jobs in June v.s 559K the previous month, unemployment rate to decline 5.6% v.s 5.8%. The surge in the US dollar index is putting pressure on the yellow metal. US ISM manufacturing came at 60.6% slightly below expectations of 61. Gold hits an intraday low of $1779 and is currently trading around $1777.

Technical:

It is facing strong support at $1760, violation below targets $1750/$1744/$1720.Bearish trend continuation only if it breaks below $1675. On the higher side, near-term resistance is around $1787, any convincing surge above will take the yellow metal to $1800/$1815/$1834 is possible.

It is good to sell on rallies around $1800 with SL around $1820 for the TP of $1700.