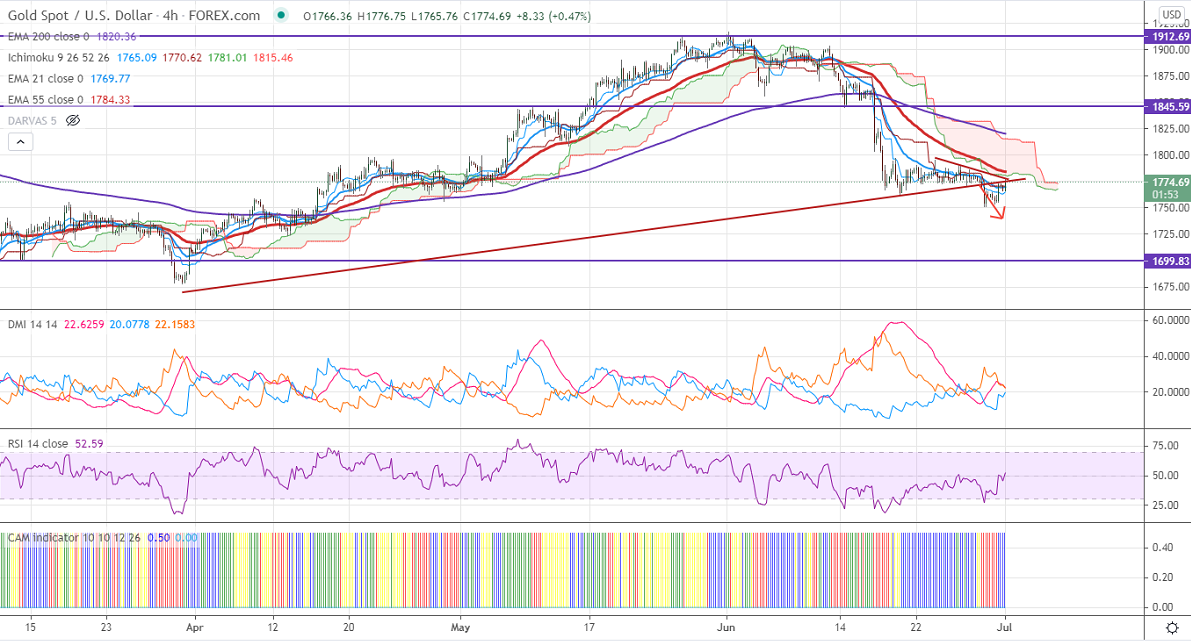

Ichimoku analysis (4- hour chart)

Tenken-Sen- $1765

Kijun-Sen- $1770

Gold has pared some of its loss made this week despite the weak US dollar. The surge in the number of coronavirus cases across the globe has increased the demand for safe-haven assets. The US dollar index gained sharply after upbeat ADP employment data. According to ADP, US private companies have added 692000 jobs in June, much better than the forecast of 55000. Markets eye US ISM manufacturing PMI and jobless claims for further direction. The US dollar index is holding well above 92 levels, breach above 92.50 confirms a bullish continuation. Gold hits an intraday low of $1776.75 and is currently trading around $1774.89.

Technical:

It is facing strong support at $1760, violation below targets $1750/$1744/$1720.Bearish trend continuation only if it breaks below $1675. On the higher side, near-term resistance is around $1787, any convincing surge above will take the yellow metal to $1800/$1812 is possible.

It is good to sell on rallies around $1775-76 with SL around $1790 for the TP of $1700.