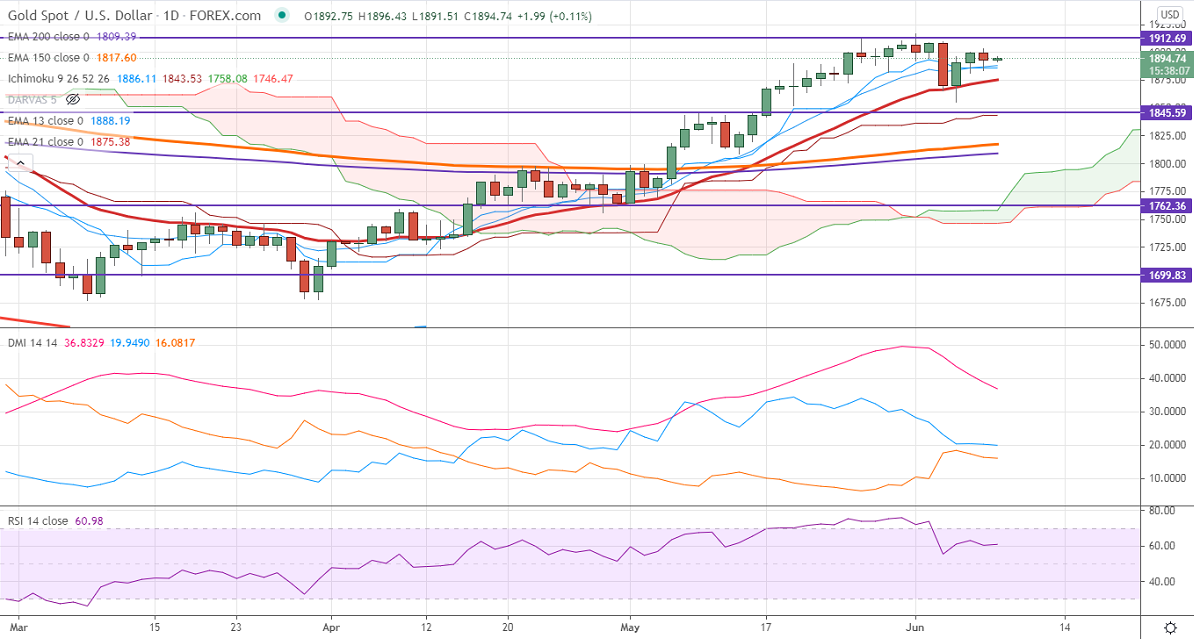

Ichimoku analysis (Daily chart)

Tenken-Sen- $1886

Kijun-Sen- $1843.50

Gold is trading flat despite a decline in US bond yields. With no further buying momentum, markets eye US CPI data for further direction. The US 10-year bond yield is trading weak for the fourth consecutive day and lost more than 5%. The US dollar index is struggling to close above 90 levels. Gold hits an intraday high of $1896 and is currently trading around $1893.50.

Technical:

It is facing strong support at $1880, violation below targets $1873/$1855/$1840/$1820. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1912, any convincing break above confirms bullish continuation. A jump to $1932/$1950 is possible.

It is good to buy on dips around $1860 with SL around $1845 for the TP of $1900.