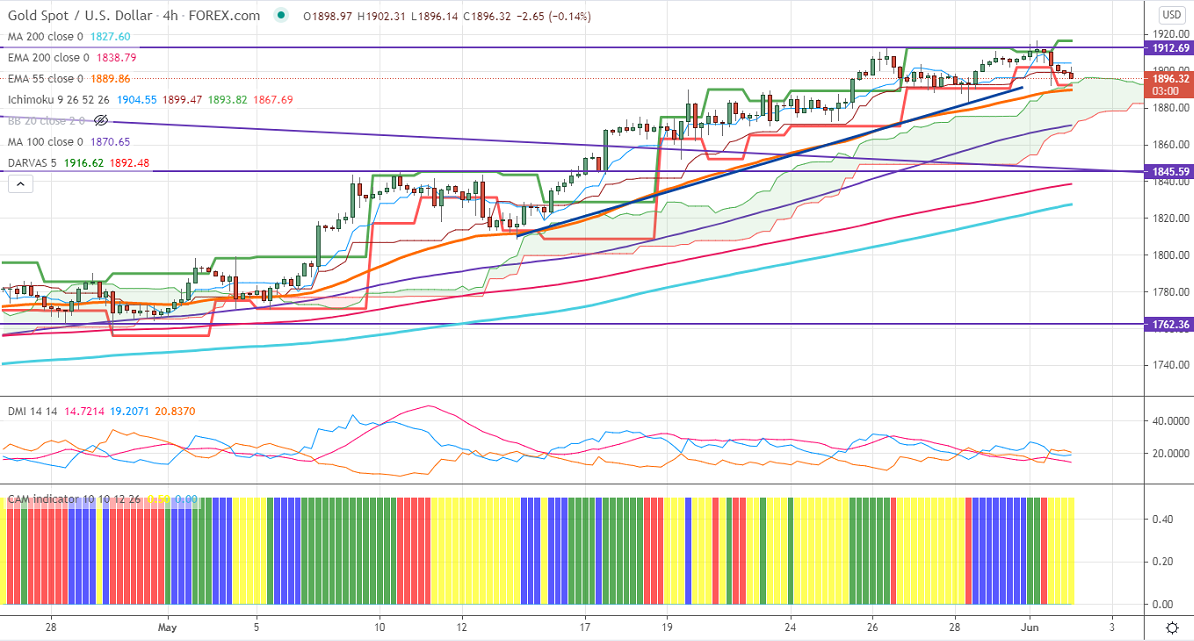

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1904

Kijun-Sen- $1899

Gold is trading in a narrow range between $1916 and $1881 for the past three days. The overall trend is on the higher side as long as support $1800 holds. The minor weakness in the US dollar index is supporting the yellow metal at lower levels. DXY recovered slightly from a low of 89.66 on the upbeat US ISM manufacturing index. The US ISM manufacturing index rose to 61.2 in May compared to a forecast of 60. The construction spending rose 0.2% less than expected in Apr after surging 1% in Mar. The US 10-year bond yield is trading lower after a minor jump to 1.64%. Gold hits an intraday high of $1902.30 and is currently trading around $1896.50.

Technical:

It is facing strong support at $1880, violation below targets $1870/$1860/$1840/$1820. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1916, any convincing break above confirms bullish continuation. A jump to $1932/$1950 is possible.

It is good to buy on dips around $1872-73 with SL around $1860 for the TP of $1900.