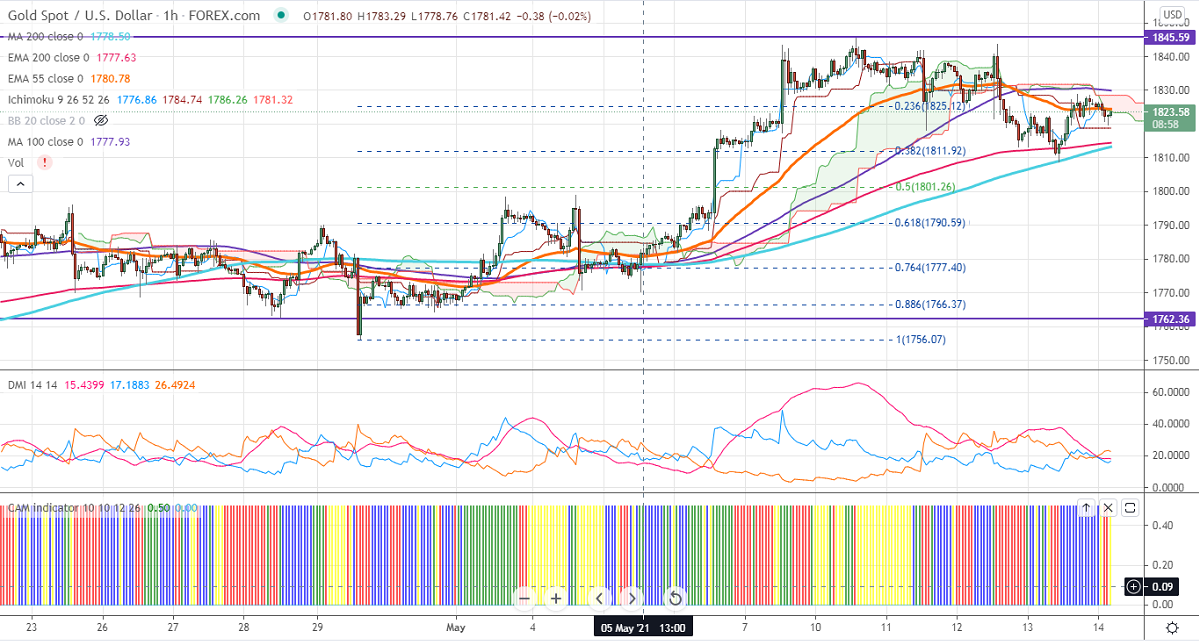

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1824

Kijun-Sen- $1818.80

Gold has shown a minor from a low of $1808. The overall trend is neutral and minor weakness only below the $1800 level. The yellow metal lost more than $40 in the past two days due to a surge in inflation. . The US Producer price index rose by 0.6% in Apr better than the forecast of 0.3%. The annual inflation jumped to 62.% vs an estimate of 3.8%. The number of people who have applied for unemployment benefits declined to 473000 weeks ended May 8th much better than the estimate of 490000. The US 10-year yield decline more than 3.5% after hitting a high of 1.705%. DXY must close above 91 levels for further jump till 91.40. The geopolitical tension between Palestine and Israel is supporting gold at lower levels. The yellow metal hits an intraday high of $1813 and is currently trading around $1817.66.

Technical:

It is facing strong support at $1807, violation below targets $1800/$1790/$1760.Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1831, any indicative break above that level will take till $1850/$1870/$1900.

It is good to sell on rallies around $1830-31 with SL around $1842 for the TP of $1790.