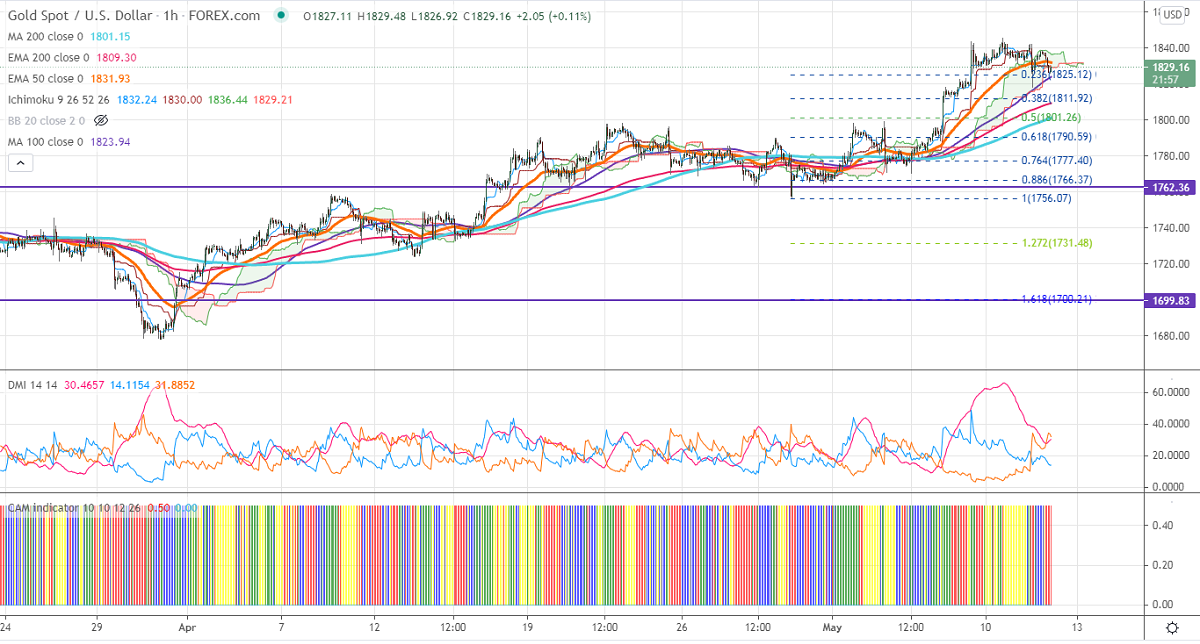

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1832

Kijun-Sen- $1830

Gold is trading slightly lower after hitting a high of $1845. The slight pullback in US bond yield is putting pressure on the yellow metal at a higher level. DXY jumped more than 40 pips from a minor bottom at 89.98. Markets eye US CPI data which is to be released today for further direction. The surge in the number of new coronavirus cases in major countries has increased demand for safe-haven assets. The US 10-year bond yield surged more than 10% from minor bottom 1.48%. The yellow metal hits a high of $1826 and is currently trading around $1829.

Technical:

It is facing strong support at $1823, violation below targets $1818/$1808/$1790/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1850, any indicative break above that level will take till $1870/$1900.

It is good to buy on dips around $1815-16 with SL around $1800 for the TP of $1870.