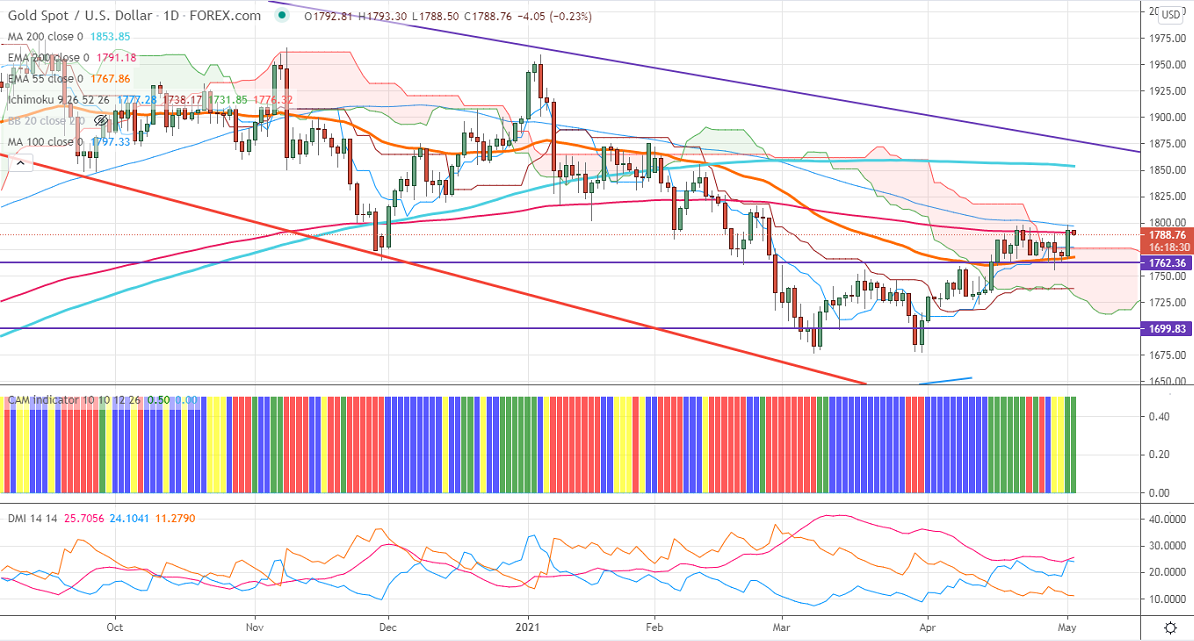

Ichimoku analysis (Daily chart)

Tenken-Sen- $1777

Kijun-Sen- $1738

Gold surged more than $30 from yesterday's low of $1766 on a minor sell-off in US bond yields. The optimistic comment from Fed Chairman Powell yesterday has dragged the yellow metal down. The minor pullback in the US dollar index from a low of 90.86 is preventing further upside. The yellow metal hits a high of $1798 and is currently trading around $1789.60.

Economic data:

The US ISM manufacturing index came at 60.7 for Apr slightly lowered compared to the forecast of 65%.

Technical:

It is facing strong support at $1777, violation below targets $1760/$1748. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1802, any indicative break above that level will take till $1821/$1832.

It is good to buy on dips around $1770 with SL around $1760 for the TP of $1802.