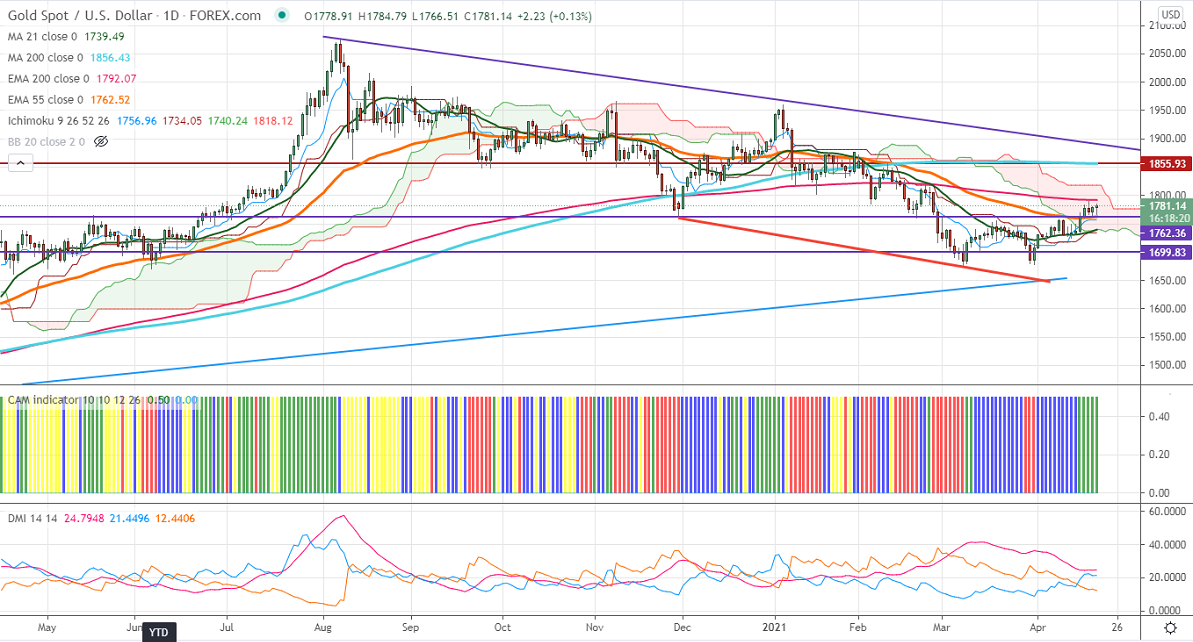

Ichimoku analysis (Daily chart)

Tenken-Sen- $1756

Kijun-Sen- $1734

Gold has recovered slightly from yesterday's low of $1763 on weakness in US bond yields. The US 10- year yield lost more than 13% from the minor top 1.77%. The slight recovery in the US dollar index is preventing the yellow metal from further upside. The index should break above 91.65 for further bullishness. The yellow metal hits an intraday high of $1784 and is currently trading around $1782.05.

Technical:

It is facing strong support at $1763, violation below targets $1751/$1740/$1730. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1792, any indicative break above that level will take till $1802/$1817.

It is good to buy on dips around $1763-64 with SL around $1750 for the TP of $1802/$1817.