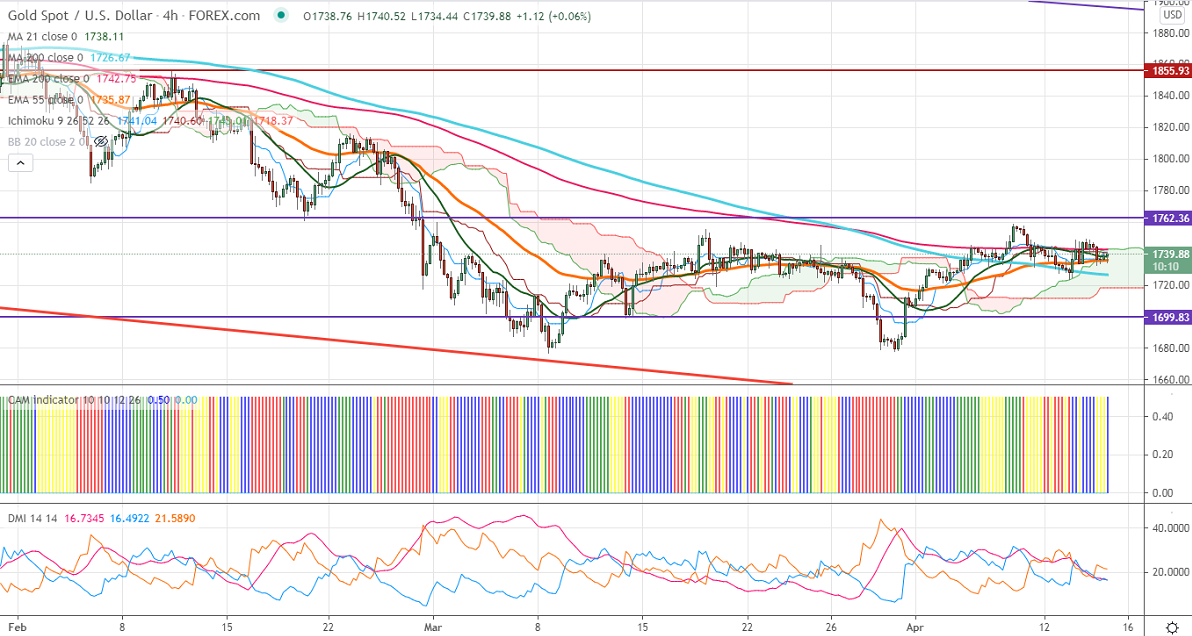

Ichimoku analysis (4 Hour chart)

Tenken-Sen- $1741

Kijun-Sen- $1740

Gold is trading slightly weak after a minor jump to $1748 despite the weak US dollar. DXY continues to trade weak and holding below 92 levels. The slight decline in US bond yields is supporting the gold at lower levels. US 10- year yield hit three weeks low and is hovering near 1.63%.

Economic data:

Markets eye US retail sales data, Philly fed manufacturing index, and jobless claims for further direction.

Technical:

It is facing strong support at $1723, violation below targets $1719/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1760, any indicative break above that level will take till $1783/$1800.

It is good to sell on rallies around $1750-51 with SL around $1760 for the TP of $1700.