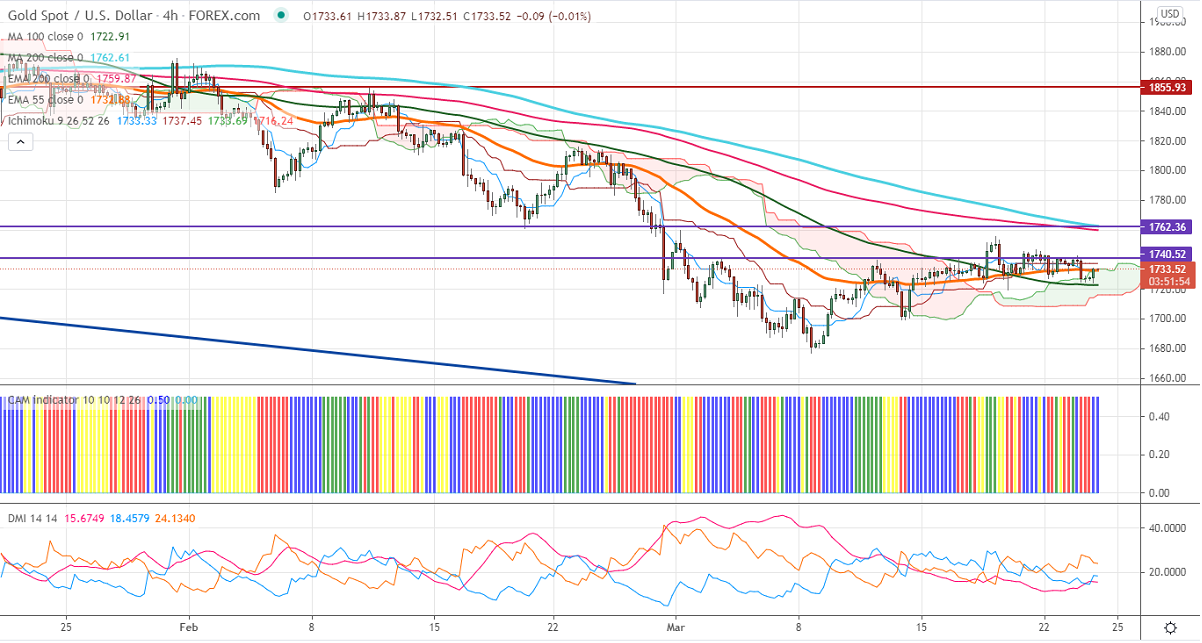

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1733.69

Kijun-Sen- $1737.45

Gold is trading in a narrow range between $1755 and $1719 for the past four days. The strong US dollar is putting pressure on yellow metal at higher levels. The slight cool-off in USA bond yield from a multi-year high is preventing the gold from major selling. US dollar index is holding well above 92, significant trend continuation only if it surges past 92.50 level. The demand for safe-haven has increased slightly after Germany and Netherlands extend their lockdown.

Economic data:

Market eyes US Core durable goods orders, flash manufacturing PMI data today for further direction.

Technical:

It is facing strong support at $1722 (100-4H MA), violation below targets $1714/$1700/$1685. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1783.

It is good to buy on dips around $1720-21 with SL around $1700 for the TP of $1760.