FxWirePro- Gold Daily Outlook

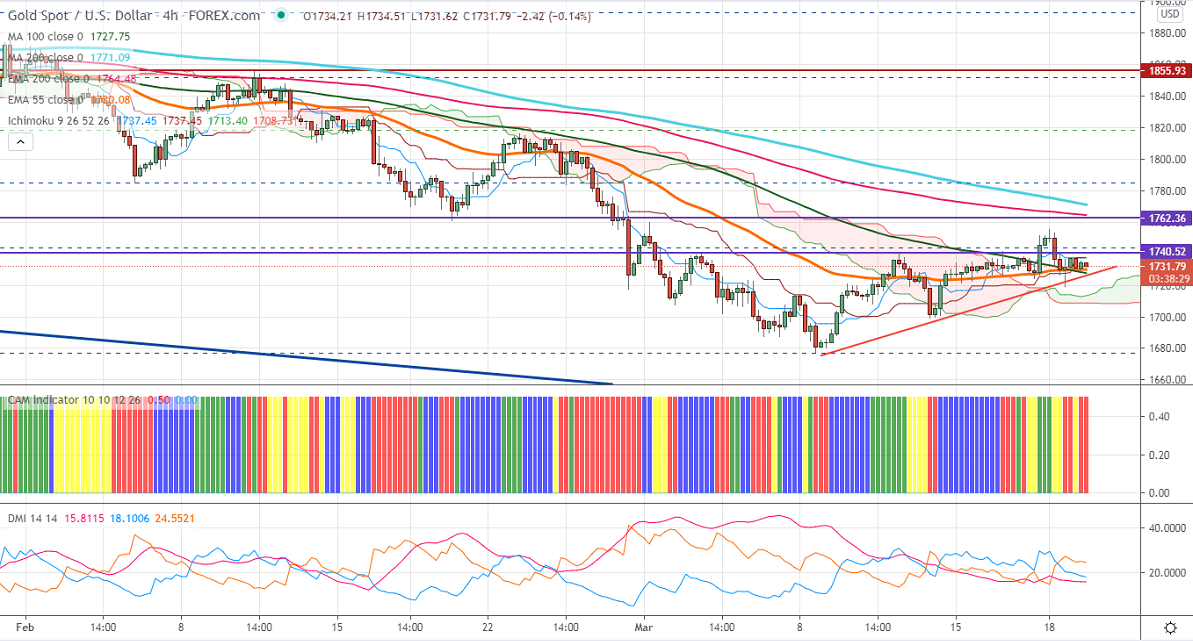

Ichimoku analysis (4 Hour chart)

Tenken-Sen- $1738

Kijun-Sen- $1725

Gold has shown a fake breakout above the trend line and declined sharply from that level. The surge in US bond yield is putting pressure on the yellow metal. The 10- year bond yield hits a 13-month high at 1.744% despite dovish comments by Fed. DXY rose more than 50 pips from the minor bottom around 91.30. The vaccine rollout and positive global economic recovery are putting pressure on gold at higher levels.

Economic data:

The number of people who have filed for unemployment benefits rose to 77000 during the week ended Mar 13th. The Philly fed manufacturing index soared to 51.80 in Mar, the highest level in 50 years.

Technical:

The yellow metal is struggling to break significant resistance at $1760. Any violation above will take the gold till $1775/$1790. On the lower side, near-term support at $1714, violation below targets $1700/$1675

It is good to sell on rallies around $1749-50 with SL around $1761 for the TP of $1700.