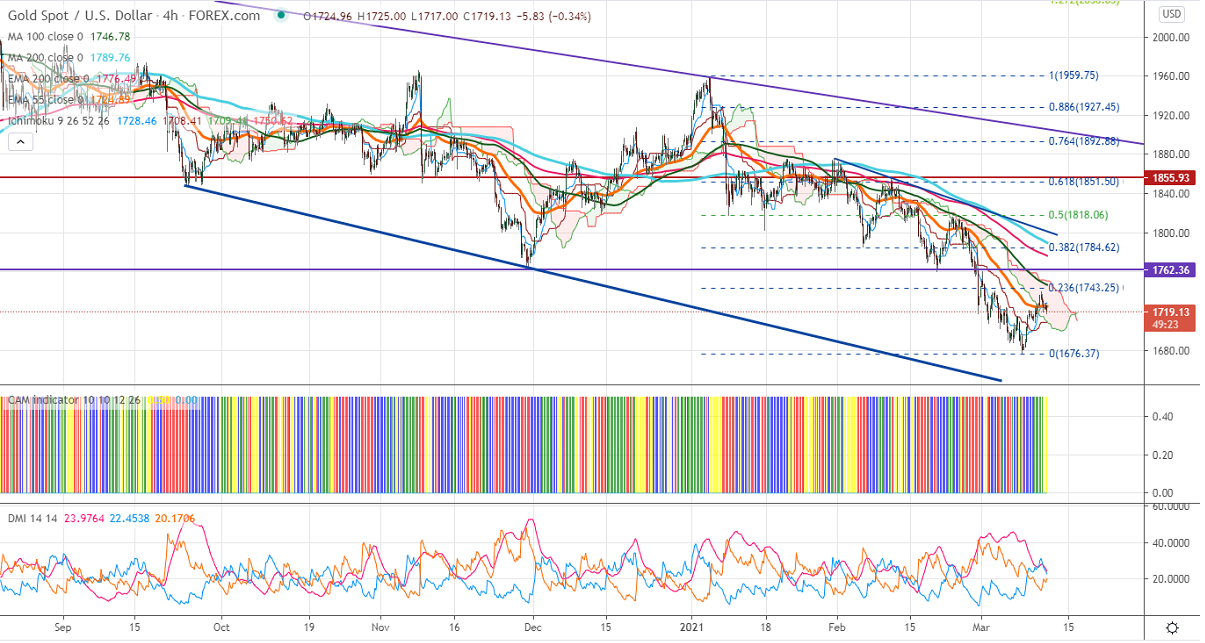

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1727

Kijun-Sen- $1708

Gold was trading higher for the past two trading days on US dollar weakness and slight profit booking in US bond yield. US 10-year bond yield lost nearly 10% after forming a temporary top around 1.622%. DXY continues to trade weak for third consecutive days and declined more than 100 pips is supporting the yellow metal price. US president Biden signed a $1.9 trillion stimulus bill to boost economic recovery.

Economic data-

The number of people who have filed for unemployment benefits has fallen to 712000 in the week ended March 6th, compared to the forecast of 730k. The European Central Bank has said after the policy meeting that the central bank is planning to increase the pace of bond buying to compete for a pandemic.

Technical:

It is facing strong resistance at $1745, violation above targets $1760/$1784. On the lower side, near-term support is around $1715, any indicative break below that level will take the pair to $1700/$1675/$1650.

Ichimoku analysis – The yellow metal is holding above Kijun –Sen ($1702) and trading slightly below Tenken-Sen. Any violation above cloud bottom $1751 confirms bullish continuation.

It is good to sell on rallies around $1743-44 with SL around $1760 for the TP of $1675.