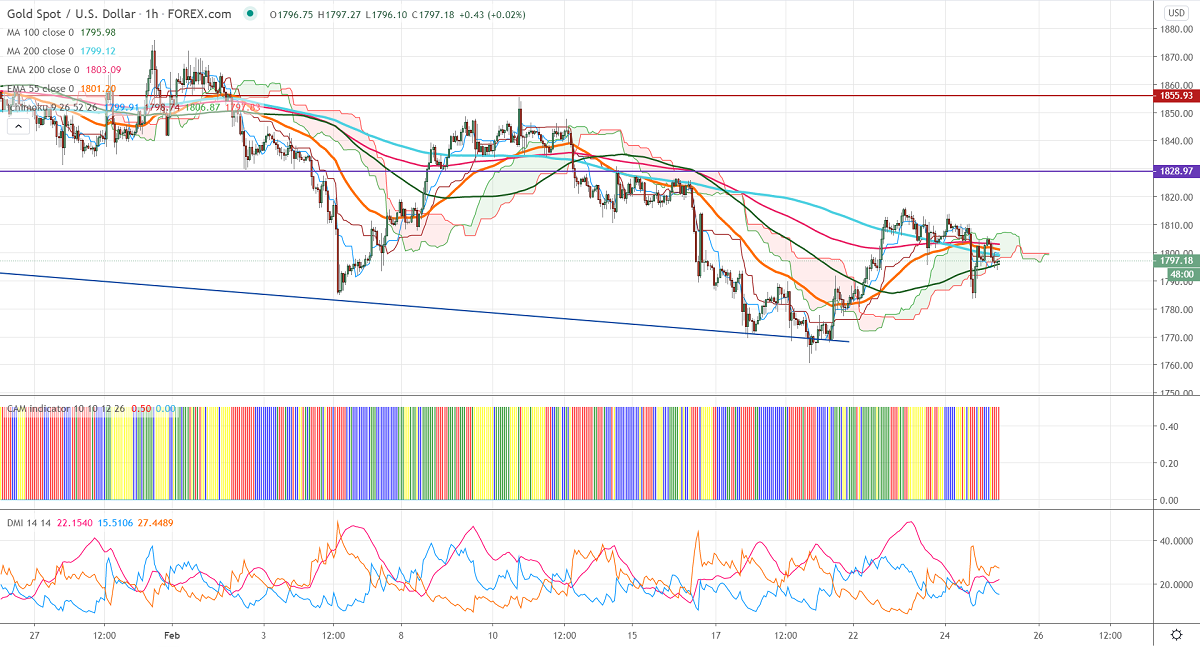

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1799

Kijun-Sen- $1798

Gold is trading below the $1800 level on weak yen and surging US bond yield. The bond yield is rising as extended stimulus might increase inflation. The US dollar index continues to trade weak, violation below 89.90 confirms bearish continuation. US new home sales surged sharply and hits 3 months high. It came at a 923000 annualized pace in Jan compared to a forecast of 856000. Market eyes US Prelim GDP and durable goods orders for further direction.

Technical:

The yellow metal is facing significant support at $1790, any violation below will drag the commodity to $1760/$1750.The significant nearby resistance is $1816, any indicative break above will take the gold till $1829/$1837/$1850.

It is good to sell on rallies around $1838-40 with SL around $1860 for the TP of $1760.