Ichimoku analysis (Hourly chart)

Tenken-Sen- $1795

Kijun-Sen- $1787

Gold recovered more than $50 on the weak US dollar. The US dollar index has shown a sell-off, any close below 90 will drag the index down to 89.20 level. The yield surged and hits a fresh year high on the US economic recovery prospectus. Markets eye US Fed Chairman Powell testimony and Conference board consumer confidence for further direction.

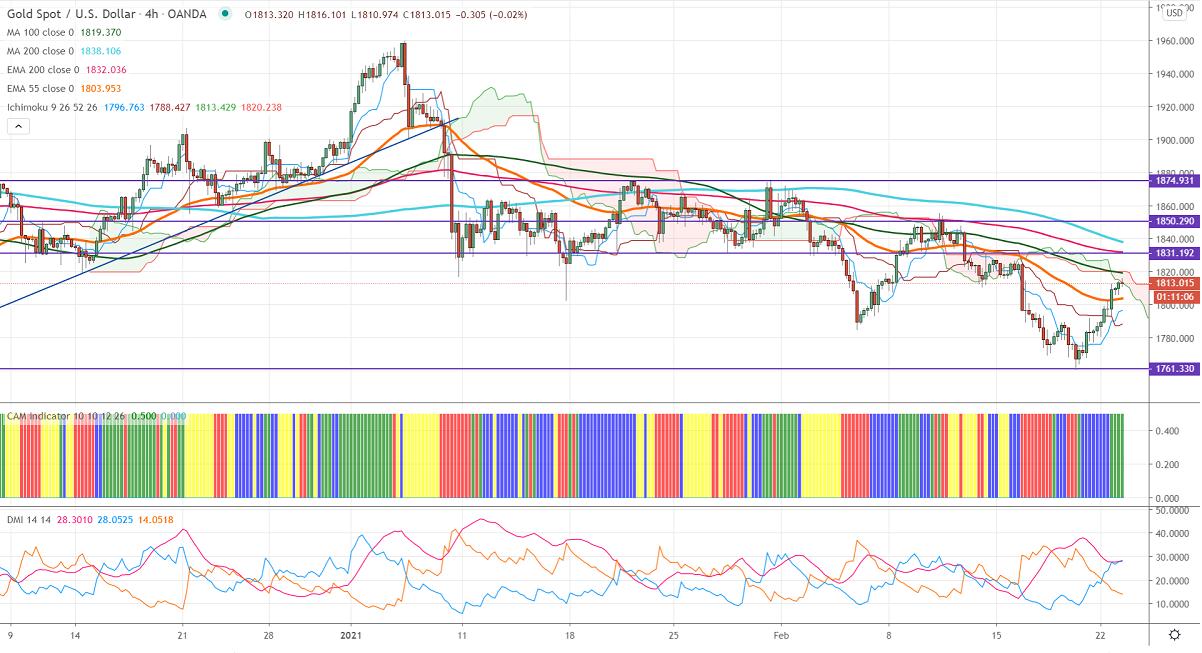

Technical:

The yellow metal is holding well above 200-H MA at $1805. The significant nearby resistance is $1820, any indicative break above will take the gold till $1837/$1860. On the lower side, near-term support is around $1800, any indicative break below that level targets $1785/$1760.

It is good to buy on dips around $1785-88 with SL around $1760 for the TP of $1860.