FxWirePro: Gold Daily Outlook

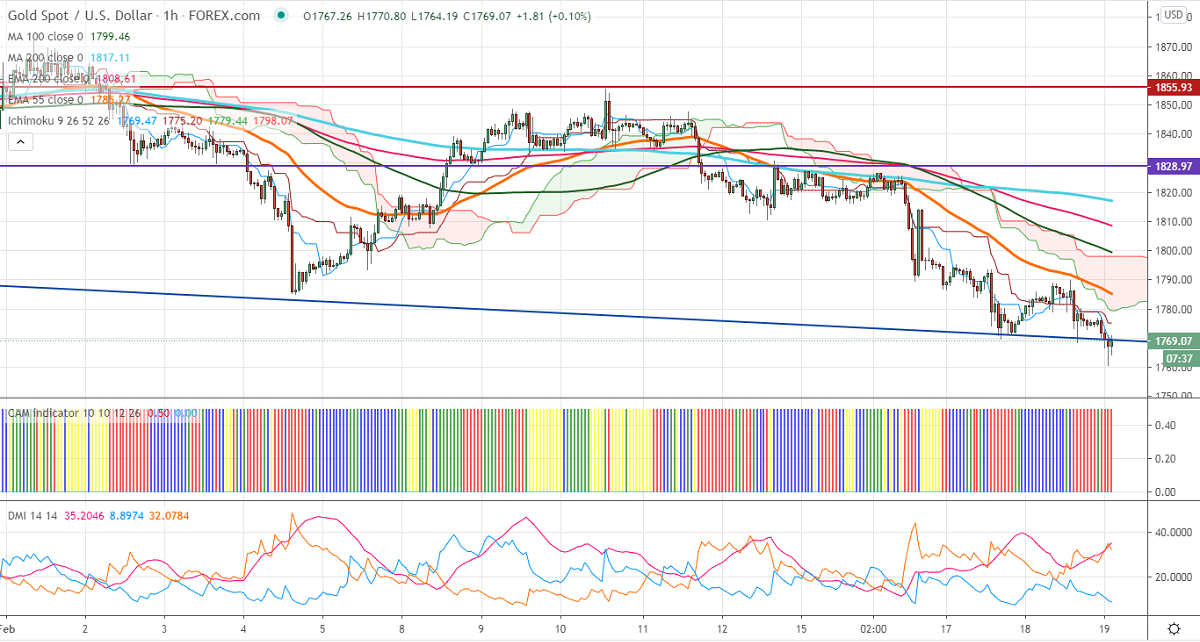

Ichimoku analysis (60 min Chart)

Tenken-Sen- $1770

Kijun-Sen- $ 1779

Gold continues to trade lower and hits 10- week low on surging US 10-year yield. The yield slipped slightly from a multi-year high despite positive US retail sales. The US dollar index lost nearly 50 pips from a high of 91.05 on weak US economic data. The number of people who have filed for unemployment benefits rose to 861000 in the week ended Feb 13 compared to a forecast of 775K. US building permits rose by 10% while housing starts plunged by 6%. The short-term trend is bearish as long as resistance $1800 holds.

Technical:

The yellow metal is facing significant resistance at $1786 (55-H EMA), any indicative break above targets $1800/$1820. It is facing strong support at $1760. Any violation below that level confirms minor bearishness, a dip till $1717/$1690likely.

Indicator (60 min chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $1778-80 with SL around $1800 for the TP of $1717.