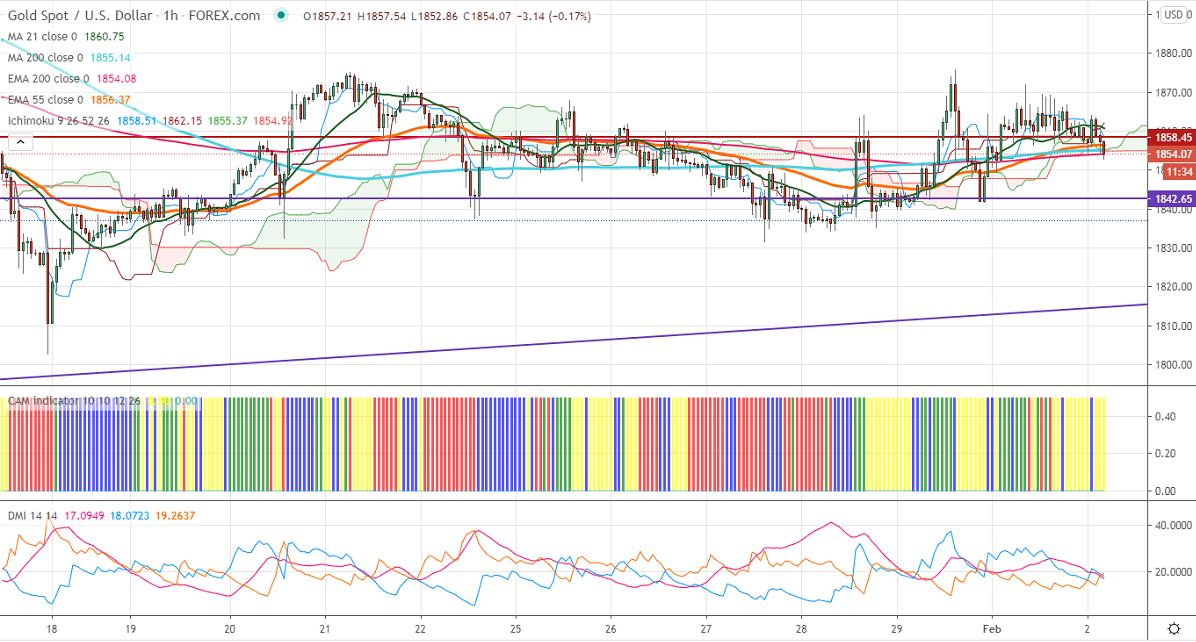

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1860.62

Kijun-Sen- $1860.52

Gold has once again declined after a minor surge above $1871. The jump in the US dollar index is putting pressure on the yellow metal at higher levels. DXY is holding well above 90 levels, significant breakout only above 91 levels. The slight recovery in the US 10-year yield is putting pressure on the yellow metal at higher levels. US ISM manufacturing PMI came at 58.70 compared to an estimate of 60.

Technical:

It is facing strong support at $1840, violation below targets $1830/$1820/$1800.On the higher side, near term resistance is around $1875, any indicative break above that level will take till $1885/$1900.

It is good to buy on dips around $1848-50 with SL around $1840 for the TP of $1900.