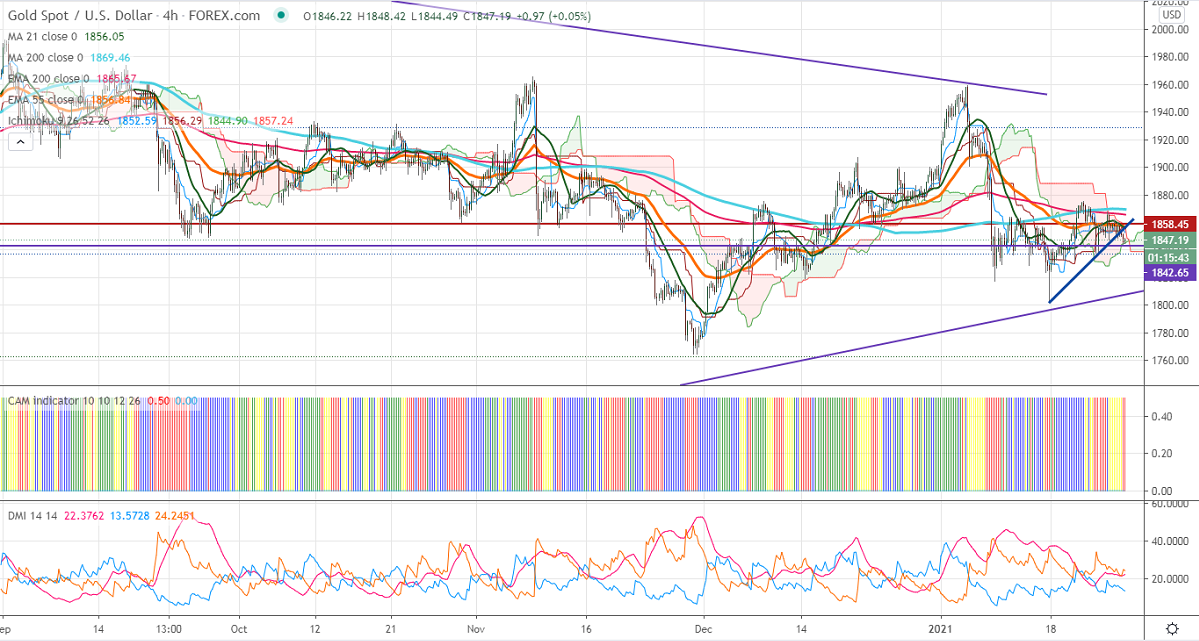

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1854.86

Kijun-Sen- $1856.30

Gold is trading in a narrow range between $1874 and $1837 for the past five trading days. The slight weakness in the US dollar and declining US bond yield supporting the yellow metal at lower levels. DXY continues to trade weak, any dip below 90 confirms a bearish continuation. Market eye US durable goods order and US Fed monetary policy for further direction.

The central bank expected to keep rates unchanged and to leave the bond-buying program at around $120 billion/month.

Technical:

It is facing strong support at $1837, violation below targets $1820/$1800.On the higher side, near term resistance is around $1856, any indicative break above that level will take till $1865/$1875/$1885/$1900.

It is good to sell on rallies around $1852-53 with SL around $1860 for the TP of $1800.