FxWirePro: Gold Daily Outlook

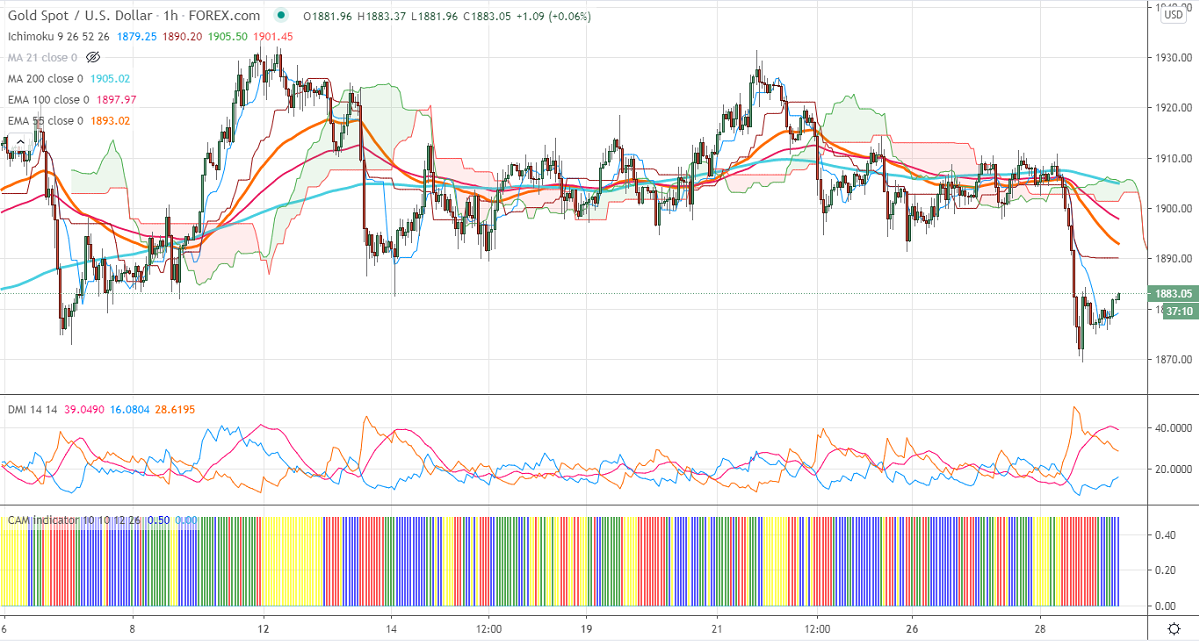

Ichimoku analysis (1-Hour chart)

Tenken-Sen- $1905.77

Kijun-Sen- $1904.73

Gold is trading below $1900 on the surging US dollar index. DXY jumped more than 70 pips on rising Coronavirus cases, declining chance of fiscal stimulus before the election. The European countries mainly France and Germany have announced for partial lockdown due to the second wave of coronavirus. The dollar index is struggling to break above 94. Any violation above will take the index till 95. The 10-year yield has halted its 5 days of weakness and jumped more than 6% from a low of 0.746%.

Economic data:

Markets eye US Advance GDP, initial jobless claims, and ECB policy meeting for further direction.

Technical:

In the 4-hour chart, Gold is facing strong resistance at $1910-$1912. Any break above will take the pair till $1921/$1933. On the lower side, near term intraday support is around $1870 and any indicative break below that level will take till $1860/$1848.

It is good to buy on dips around $1872-730 with SL around $1860 for the TP of $1920/$1933.