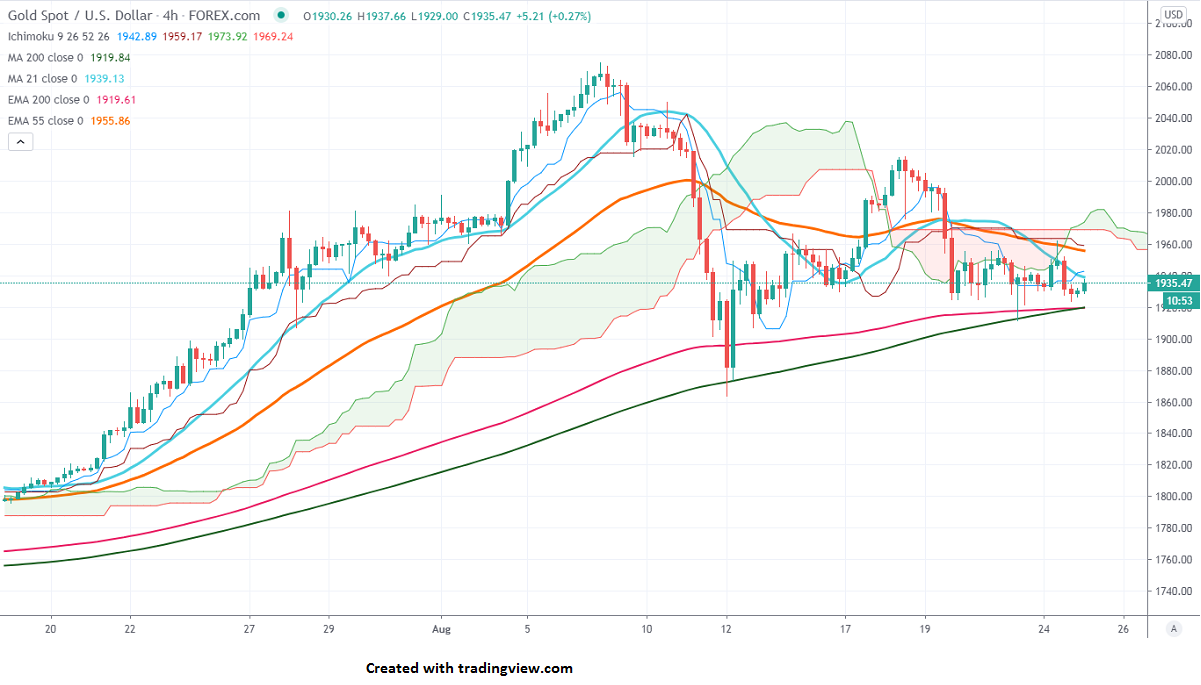

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- $1941.80

Kijun-Sen- $1959

Gold continues to trade in a narrow range between $1925 and $1961 for the past 5 days. The COVID-19 vaccine hopes and US and China trade optimism is putting pressure on the Yellow metal. Markets eye Fed's chairman speech at Jackson hole symposium. The US 10-year yield is trading slightly higher and real yield is at -1.02% from -0.97% yesterday.

US Dollar Index – Slightly Bullish (negative for yellow metal)

S&P500- Positive (negative for gold)

US Bond yield- slightly positive (negative for gold)

Technical:

The immediate support is around $1900, any indicative break below targets $1862. Major weakness only if it breaks below $1860.The near term resistance is at $1970, the violation above will take to the next level $2000/$2015.

It is good to sell on rallies around $1958-60 with SL $1975 for the TP of $1907.