FxWirePro: Gold Daily Outlook

Ichimoku Analysis (Daily Chart)

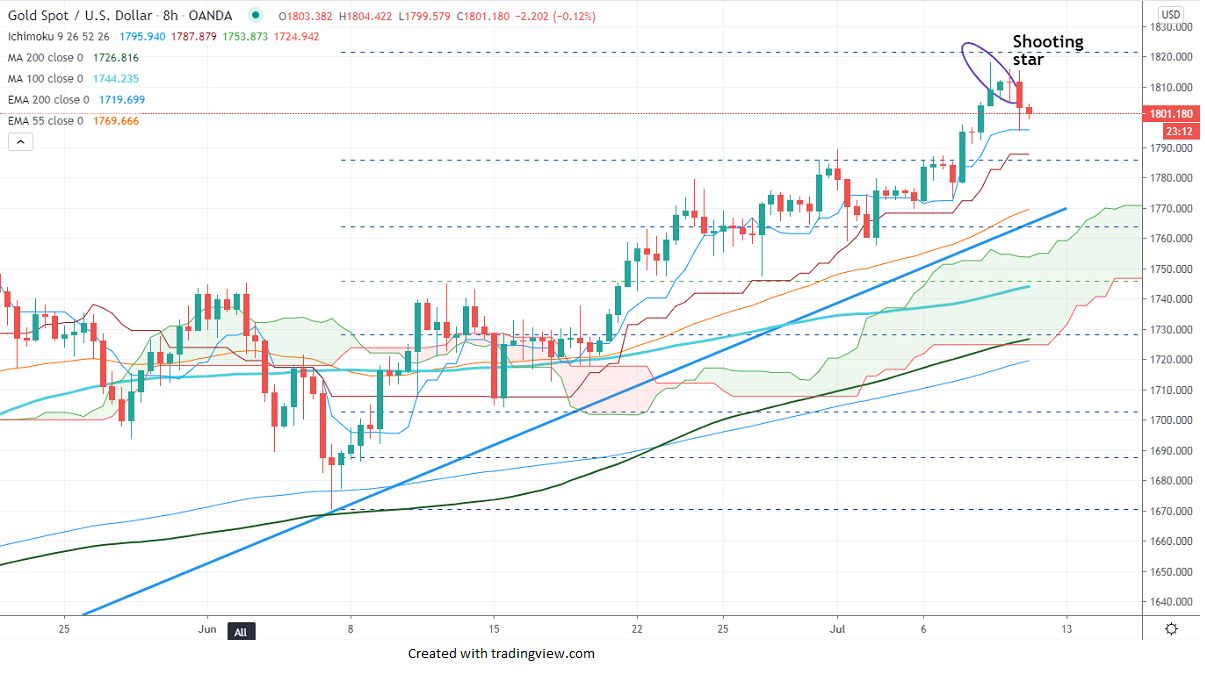

Tenken-Sen- $1772

Kijun-Sen- $1733

Gold has soared sharply and hits multi-year high amid a slumping dollar. US dollar gained slightly after slightly better than expected US jobless claims. The number of people filed for unemployment benefits declined to 4- month low of 1.314 million vs forecast of 1.41 million, but layoff is increasing. The total of new coronavirus cases crossed 60000 in the past 24 hours for the first time 3.15 million in the USA. Globally total number cases crossed 12 million with deaths around 552112.

US Dollar Index – Bullish (bearish for yellow metal)

S&P500- Weak (Positive for gold)

US Bond yield- Slightly weak (bullish for gold)

Technical:

The yellow metal's near term resistance is around $1820, any violation above confirms bullish continuation. A jump till $1845/$1860 (161.8% fib) likely

The immediate support is around $1795 (Tenken-Sen), any indicative break beneath targets $1782 (23.6% fib)/$1747.

Oscillator

RSI- 72 (Bearish divergence)

It is good to sell on rallies around $1802-05 with SL around $1820 for the TP at $1761.