- Gold has shown a minor decline after hitting 5 –day high on Wednesday after FOMC meeting. The US dollar index recovered slightly after hitting low of 93.28. The yellow metal declined till $1250 and it is currently trading around $1254

. - The ECB has kept its interest rates unchanged and announced no changes in asset purchase program. The central bank has upgraded growth outlook for 2018 from 1.8% to 2.3% and raised the inflation target for 2018 by 0.2pp to 1.1%. The meeting showed that ECB is in wait and watch mode for QE exit and policy normalization.

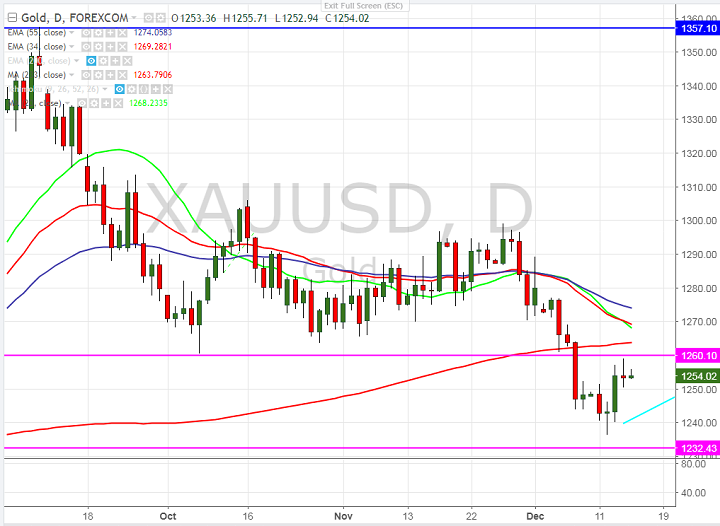

- On the higher side, near term resistance is around $1263 (233- day MA) and any break above will take the yellow metal to next level till $1269 (200- day EMA)/$1275 (55-day EMA).

- The near term major support is at $1236 and any violation below will drag the metal to next level till $1232 (161.8% retracement of $1305 and $1260.45)/$1223 (88.6% retracement of $1204.70 and $1357). Overall bullish invalidation only below $1200. The minor support is around $1250/$1243.

It is good to buy on dips around $1250-52 with SL around $1243 for the TP of $1263/$1269.