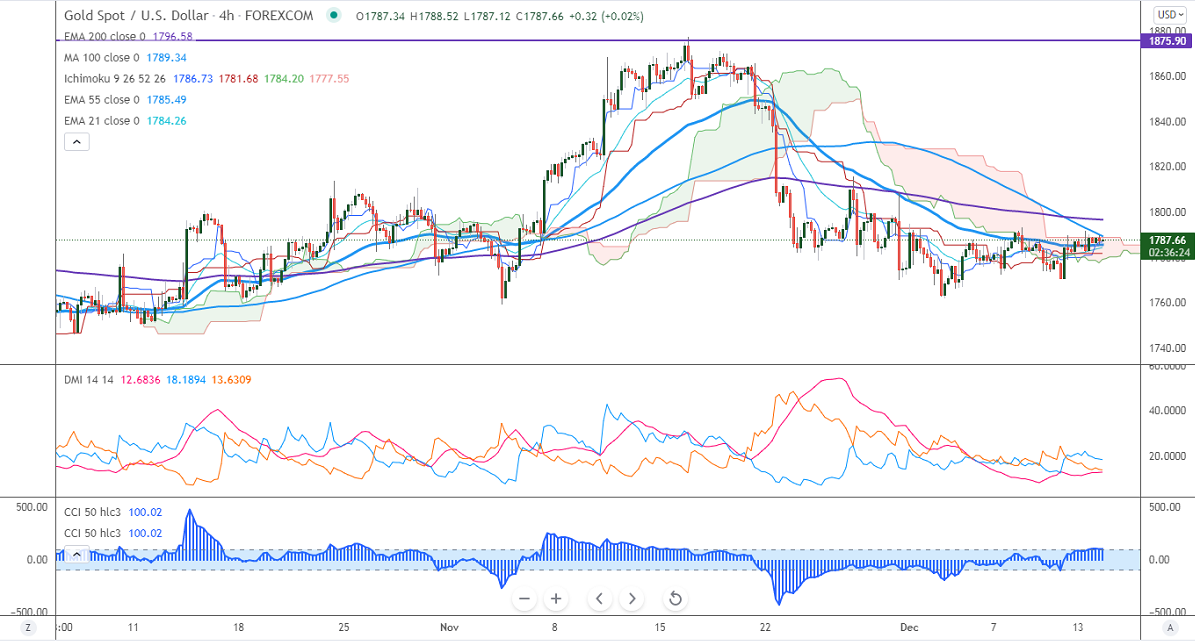

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1786.50

Kijun-Sen- $1781.68

Gold is trading in a narrow range between $1770 and $1791.50. Markets eye Fed monetary policy meeting for further direction. US dollar index climbs more than 40 pips as first death due to Omicron supporting at lower levels. The bearish trend in US treasury yield is preventing the yellow metal from further downside.

Economic data-

US PPI – 1:30 pm

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- neutral (mixed for gold)

Technical:

It faces strong support at $1770, violation below targets $1760/$1740/$1700.Significant trend continuation only below $1675. The yellow metal facing strong resistance $1792, any violation above will take to the next level $1800/$1815/$1835/$1860/$1900 is possible.

It is good to sell on rallies around $1800-01 with SL around $1815 for TP of $1762/$1740.