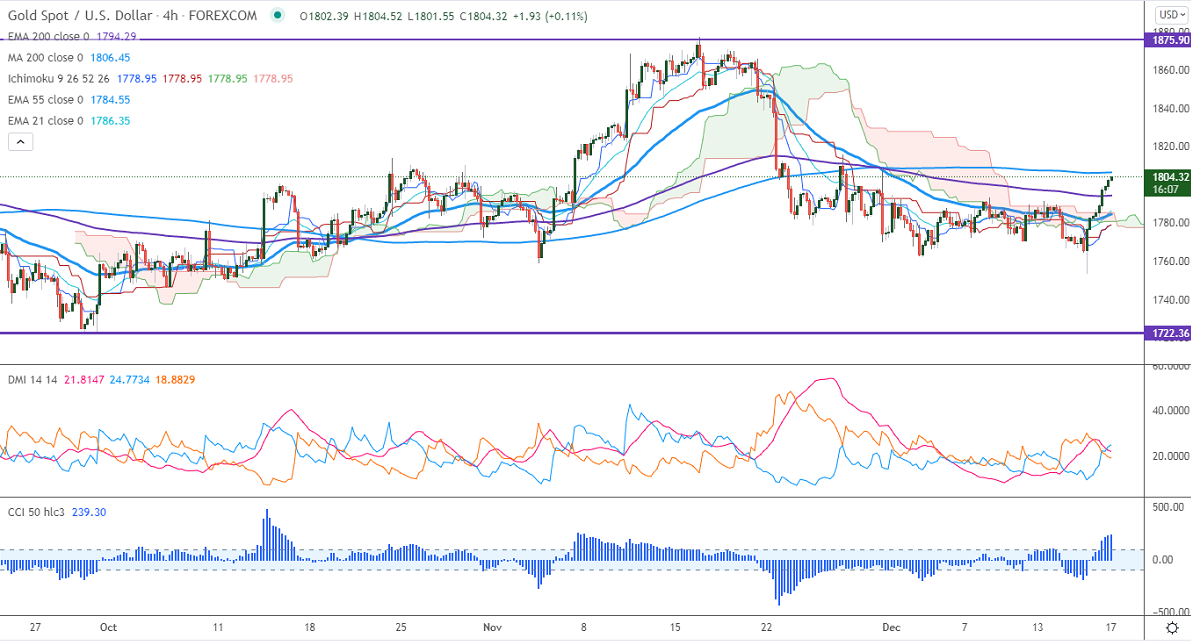

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1779.47

Kijun-Sen- $1779.47

Gold recovered sharply above $1800 on Omicron fears and declining yields. France has banned travelers from Britain due to a surge in the coronavirus in the UK which has increased the demand for safe-haven assets. The yellow metal hits a high of $1804.59 and is currently trading around $1803.02.

The number of people who have filed for unemployment benefits the previous week rose to 206000 compared to a forecast of 196K.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- bearish (positive for gold)

Technical:

It faces strong support at $1780, violation below targets $1770/$1760/$1740/$1700.Significant trend continuation only below $1675. The yellow metal facing strong resistance $1815, any violation above will take to the next level $1835/$1860/$1900 is possible.

It is good to buy on dips around $1778-80 with SL around $1760 for TP of $1835.