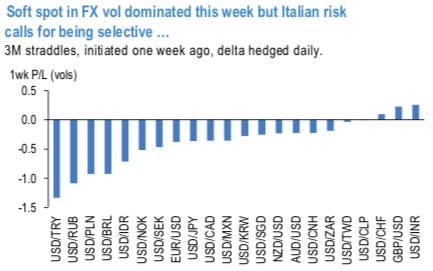

Central banks, US-China tariffs tit for tat and the US political noise did little to revive soft realized FX vols. Trade tensions have roiled markets for the better part of the year but markets’ fatigue, judging by lack of reaction in spot markets, should be supportive for a little longer for selective and tactical vol shorts.

That surely de-escalated quickly, as the euro seemed under extreme pressure yesterday owing to the renewed Italexit fears which were triggered by known Eurosceptic and top Italian lawmaker Claudio Borghi saying that Italy having its own currency would solve its debt issues. But seeing the sharp market reaction, not only Borghi has by now back-pedalled by assuring the market that the government had no plans of leaving the euro zone but also the government is said to be caving in to the EU’s demands to lower its deficit targets. Now, as always, the devil is in the details. The euro’s recovery will only continue if the new fiscal plans are also feasible.

Meanwhile, PM May is set to address the Conservative Party Conference. While the market’s focus is on Brexit and any deviation away from the "Chequers" deal, or not – Boris Johnson, in his speech yesterday, backed May as leader but urged the PM to ‘chuck Chequers’ and move towards a Canadian style deal. She will likely avoid detailed discussion and appeal for unity.

The 1st chart indicates the breadth of the realized vol softness with >80% of the depicted USD universe falling prey to soft realized (the key culprit of underperformance). The broad USD implied vol – realized vol gap widened further, but the realized vols got near the levels of the prior reversals (refer 2nd chart).

European political risk and quarter end spot moves increase risk of realized vol comeback, though to us the backdrop remains supportive of the last week’s vol shorts in EURPLN and USDIDR when we highlighted EM vol to have had peaked. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -52 levels (which is bearish), hourly USD spot index was at 105 (bullish) while articulating at (12:11 GMT). For more details on the index, please refer below weblink:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays