The German bund prices are expected to remain weak for a short period, following the improvement in investors’ risk appetite as the U.S.-China trade tensions started to ease, after a lengthy period of uncertainties and trade war worries.

Investors will now keep an eye over Eurozone’s consumer price inflation for the month of June, scheduled to be released on July 18 by 09:00GMT and of utmost importance, on the summit between U.S. President Donald Trump and Russian counterpart Vladimir Putin, scheduled to be held today in the Finnish capital, Helsinki.

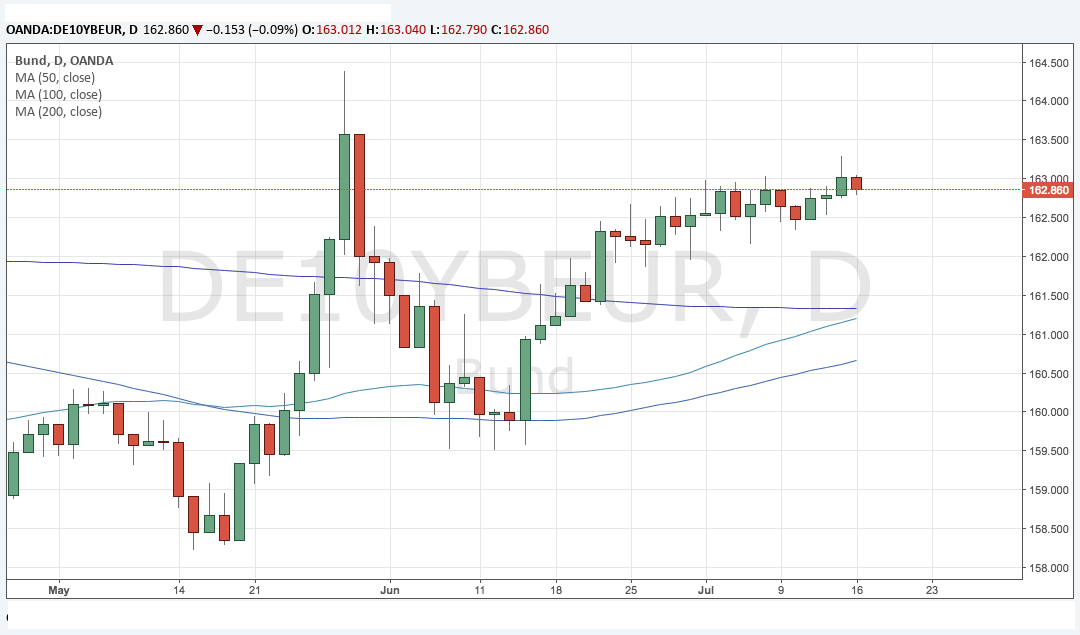

Although prices remain volatile in a fluctuating market scenario over past few days, any steep fall could see prices plunging below 162.154 and bearishness below could drag till 161.34 (200-day MA).

The German 10-year bond yields, which move inversely to its price, rose 1 basis point to 0.29 percent, the yield on 30-year note also edged higher by nearly 1 basis point to 1.02 percent and the yield on short-term 2-year traded tad higher at -0.65 percent by 09:50GMT.

The coming week’s euro area data calendar is relatively sparse. June trade figures will be announced today, with new car registration numbers due tomorrow. Wednesday brings final euro area inflation figures for June.

While a downward revision was seen in France, the euro area numbers still seem highly likely to confirm the flash estimates, with headline inflation up 0.1ppt from May to 2.0 percent y/y, but core inflation down 0.1ppt to just 1.0 percent y/y, still firmly within the range of the past four years. Construction output figures for June are also due on Wednesday. And the ECB’s euro area balance of payments are due at the end of the week.

Lastly, U.S. President Donald Trump has said ties with Russia have "NEVER been worse" and blamed US politicians, ahead of his first-ever summit with counterpart Vladimir Putin. In a tweet the US president denounced his predecessor's "stupidity" and the "rigged" inquiry into alleged Russian interference in the 2016 election, BBC News reported.

Meanwhile, the German DAX traded 0.17 percent higher at 12,561.97 by 10:00GMT, while at 10:10GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at 43.86 (higher than +75 represents bullish trend). For more details, visit http://www.fxwirepro.com/currencyindex

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election