With the movement of the underlying spot FX, someone has to change the price of the delta as the option moves from ATM to OTM and then back to ATM to ITM.

Well, on the pool of FX gamma that we like owning is AUDCHF after events this week. The commotion in the Swiss franc on the newsflash of the Russian sanctions broke and prompted speculation of Russian liquidation of Swiss assets created atypically sharp CHF weakness which may or may not have run its course.

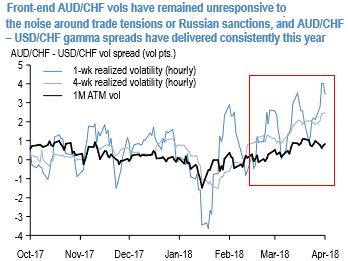

But AUDCHF gamma outperformance dates back even further when gyrations in AUD in response to trade headlines / SPX swings kept realized vols persistently elevated even as 1M ATMs stubbornly traded 2-3% pts. under. Put differently, AUD vs CHF correlations have under-realized implied expectations to the tune of 20-25% pts. over the past month, and the traditionally opposite risk betas of the two currencies provides encouragement that the de-coupling can continue even if a strong earnings season provides a tailwind for equity markets.

1M 30D AUD calls/CHF puts that form the trough of the AUDCHF vol surface and trade 0.20 pts. under ATMs are our preferred options to buy; owning the weak side of the skew (CHF puts) has systematically beaten CHF calls across CHF pairs, and could well be in play over the next few weeks if the mix of stronger equities and lingering CHF liquidation flows push AUDCHF higher.

We fund this by selling 1M 30D USD puts/CHF calls, which earn smile theta by selling the strong side of the skew, where a range-bound USD has tamed realized vol and punitive negative carry appears to be dis-incentivizing option purchases from the levered investor community and keeping implied vols in check. The resulting gamma spread has been a one-way performer this year (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 20 levels (which is mildly bullish), while hourly CHF spot index was at 12 (neutral) while articulating at 13:13 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays